Finance

FCMB Group to acquire 96% of AIICO Pensions

FCMB Group and AIICO Insurance have notified the Nigerian Stock Exchange (NSE) and the investing public of discussions for sale of 96 per cent stake of AIICO Pensions Managers to FCMB Pensions. This is disclosed in separate statements by FCMB Group and AIICO Insurance on Friday posted on the Exchange website. FCMB Group in a statement signed by Mr Kayode Adewuyi, Chief Financial Officer and Mr Ladi Balogun, its Group Chief Executive Officer, said the proposed acquisition would make AIICO Pensions an indirect subsidiary of FCMB Group.

They said both organisations had entered into discussions with shareholders of AIICO Pension Managers to acquire the 70 per cent stake held by AIICO Insurance and 26 per cent held by some other shareholders in AIICO Pensions. According to the statement, the proposed transaction is subject to the approvals of the National Pension Commission and the Federal Competition and Consumer Protection Commission. “We shall notify the NSE and the investing public once the relevant approvals for the transaction are received,” it said.

In the same vein, AIICO, in a statement signed by the Company Secretary, Mr Donald Kanu, said at the conclusion of the proposed sale, AIICO Pensions shall cease to be a subsidiary of AIICO Insurance Plc. “The proposed sale is AIICO’s stake of 70 per cent and other shareholders stakes of 26 per cent thus bringing the cumulative sale of 96 pe cent stake to be purchased by FCMB Pensions,” Kanu said. He said that the company would notify NSE once the relevant approvals for the transaction were received. (NAN)

-

News2 days ago

News2 days agoPPP key to Nigeria’s economic resilience– PenCom boss

-

News2 days ago

News2 days agoECOWAS Bank for Investment, Development appoints Baba Malick regional director Abidjan office

-

Finance2 days ago

Finance2 days agoSanwo-Olu seeks collaboration to position Lagos as Financial Hub

-

Oil and Gas2 days ago

Oil and Gas2 days agoBrent crude hovers at $67 per a barrel Oil as OPEC output falls in January on lower supply from Nigeria, Libya

-

News2 days ago

News2 days agoOgoni releases N200m to strengthen businesses

-

News15 hours ago

News15 hours agoFAAN, cargo agents reach agreement on airport charges at MMIA

-

Finance15 hours ago

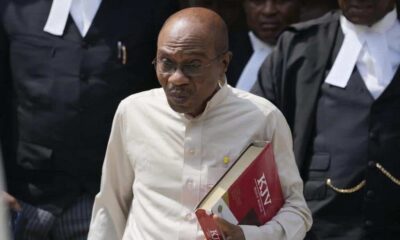

Finance15 hours agoBanks hoarded redesigned naira, EFCC witness tells court in ex-CBN governor Emefiele’s trial

-

News15 hours ago

News15 hours agoLagos, Enugu, Kebbi, 10 other states to experience longer-than-normal length of rainy season: NiMet