Economy

My encounter with a Nigeria economic patriot, Godwin Emefiele

By Omoh Gabriel, Publisher, Businessnewsreport

Perhaps, destiny has a way of bringing people together. Sometimes by chance and some other times by way of work. It was in Washington in 2010 at a seminar presided over by Oby Ezekwesili, then Vice President Africa World Bank Group, that the Managing Director of one of Nigeria’s Banks walked in after several back-to-back meetings. The place was jam-packed and every available seat was occupied. The gentle man quietly stood on the side as the usher did not know who he was. For those of us from Nigeria, we knew him, the managing Director of Nigeria’s largest bank by tier 1 Capital. For the sake of the country, he was ready to stand through the session and gather the much he could get standing. I approached one of the ushers to find him a seat but he snubbed me as a way of saying this is Washinton and not Nigeria. I offered my seat. He sat through and made copious notes. He later walked away just as quietly as he had come in.

Several years after, when I was the Business Editor of a leading newspaper in the country, I got a call from one of my several contacts at Zenith Bank. He requested me to do “something very urgent” for his MD, pleading that the task be turned in the next day. I obliged him. It was the MD’s profile. I removed one of the early pages and replaced it with the material. It came out and the management of the paper protested and threatened to issue me an invoice to pay for the page. I was arranging to ask that it be deducted from my monthly salary when I got a call from the editor saying that my “friend” had been nominated for the position of Central Bank Governor by President Goodluck Jonathan. What is curious about this is the fact that the bank he managed then was very media friendly. As one of the pioneering directors of the bank, they had put in place empowerment of the media. They introduced pre-paid bulk advert placement in the Nigerian newspaper industry and allowed journalists to take the commission. This empowered both media houses and journalists. The prosperity most media houses enjoyed before the 2016 recession in the economy was a product of this effort as other banks keyed into their initiative. So, this man has the disposition of empowerment of the masses. Many journalists, as well as advert executives, benefitted from the bank’s generosity. So when Mr. Godwin Emefiele faced the senate for screening for the position of Central Bank of Nigeria Governor, he was not saying anything new that many in Nigeria media were not aware of when he said loud and clear that he would take the CBN developmental mandate to its zenith.

To keep his promise to the nation, when he assumed office as the tenth indigenous Governor of the CBN, in June 2014, the Bank, under his leadership, has had to come up with new strategies to navigate the depressed Nigerian economy, through hurdles such as the challenge of foreign exchange inflow, multiple exchange rates, economic recession, stagflation, financial inclusion and the gap in the value chains in the agricultural sector. With the clear understanding of what he was called to do, he immediately identified the grey area of massive importation of what were non essentials to the survival of the economy. Thinking out of the box, he fashioned out policies to address some of them, following IMF/World Bank advice that each country should seek unorthodox ways to revive their respective economies as a result of global economic down turn occasioned by collapse of crude oil prices. At his mother’s burial reception ceremony, many were shocked that as CBN governor only palm wine was served. There were no choice drinks for any one who was at the event.

He immediately attacked importation of stockfish, rice, toothpicks among others to give effect to his sermon of eat what we can produce. This generated local and global upheavals. In spite of scathing criticism from some analysts who argued that the CBN had gone beyond its monetary policy mandate by delving into developmental issues, which the CBN Act (2007), as amended, recognises, Emefiele and his team at the CBN remained committed to the patriotic goal of ensuring economic stability, through the Bank’s numerous developmental interventions. Their efforts paid off handsomely when the economy emerged from a deep recession it entered into in 2016 in 2018 and again in 2020.

The CBN, under Emefiele, has among other steps, inspired the rice revolution through its Anchor Borrowers’ Programme, ABP, which has led to a near zero importation of rice into the country. This has become one of the spikes in the Buhari-led federal government. The governor has also been the arrow head in the push for a diversification of the country’s revenue base with emphasis on agriculture and small businesses. True to his conviction, he has pushed through bold and courageous measures geared at reducing the huge sums spent by the country on importing items such as fish and rice, which went as high as N1.3 trillion a year. The tenacious implementation of the Bank’s policy of restricting access to forex from the Nigerian forex market to some 43 items, has led to huge improvements in the domestic production of these items and a reduction in Nigeria’s import bill and has generated millions of direct and indirect jobs for Nigerians. For the first time, quality tooth picks are being produced in Nigeria as a result of investments made in the sector through CBN’s efforts. Such investors are now smiling to their banks as a result of good returns on investment. In its efforts to motivate the financial service sector to pay more attention to the real sector the CBN has worked with other stake holders to champion various initiative to spur wealth creation and employment generation through accommodating policies.

It now a well known fact that the CBN initiated the Agri-Business/Small and Medium Enterprises Investment Scheme (AGSMEIS) to support SMEs the engine of economic growth of any nation. Other programmes put in place by the apex bank in this direction include: Accelerated Agricultural Development Scheme (AADS); Youth Entrepreneurship Development Scheme (YEDP); The National Collateral Registry (NCR); and lately; The Creative Industry Financing Initiative (CIFI). The apex Bank has also introduced critical intervention schemes such as the Nigeria Electricity Market Stabilisation Facility, NEMSF, the Nigerian Bulk Electricity Trading-Payment Assurance Facility, NBET-PAF, the Presidential Fertiliser Initiative, and the Shared Agent Network Expansion Facility, SANEF, among others. These economic renaissance embarked upon by the CBN under Emefiele did not go un noticed as they directly supported government effort to diversify the economy. In recognition of these noble effort the President did not hesitate to nominate Emefiele for a second term despite pressure from different areas pushing for a replacement.

The CBN as expected at the struck of the global pandemic COVID-19 rose to the occasion by putting in place financial measures to help mitigate the negative impact of the pandemic on households and businesses in Nigeria. Some of these measures are a one-year extension of the moratorium on principal repayments for CBN intervention facilities; regulatory forbearance granted to banks to restructure loans given to sectors that were severally affected by the pandemic; reduction of the interest rate on CBN intervention loans from nine to five per cent; mobilisation of key stakeholders in the Nigerian economy through the CACOVID alliance, which led to the provision of over N27 billion in relief materials to affected households, and the set-up of 39 isolation centres across the country; strengthening of the loan to deposit ratio policy, which resulted in a significant rise in loans provided by financial institutions to banking customers.

By the last report, loans given to the private sector, had risen by over 21 per cent. Other measures include creation of N100 billion Target Credit Facility, TCF, for affected households and small and medium enterprises through the NIRSAL Microfinance Bank; creation of a N100 billion intervention fund in loans to pharmaceutical companies and healthcare practitioners intending to expand and strengthen the capacity of healthcare institutions; creation of a research fund, which is designed to support the development of vaccines in Nigeria; and a N1 trillion facility in loans to boost local manufacturing and production across critical sectors. Also in line with its desire to stimulate the economy to boost employment across different sectors, the CBN recently introduced initiatives such as the Intervention Facility for the National Gas Expansion Programme; the Solar Connection Intervention Facility; and the CBN Facility Homes Financing Initiative.

Emefiele, in his desire to promote a strong and credible payment system as well as deepen financial inclusion, approved the licensing of more Payment Service Banks, PSBs. Only recently, CBN has also gone ahead with measures aimed at deepening the foreign exchange market, providing more liquidity, and creating more transparency in the administration of Diaspora remittances into Nigeria. With this move, all beneficiaries shall have unfettered access and utilisation to such foreign currency proceeds, either in forex cash or in their domiciliary account. Interestingly, the CBN was principal partner to the federal government in the setting up of the N15 Trillion Infrastructure Company, InfraCo, Fund, to be independently managed. Nigerians are aware that it was set up to drive a self-sufficient economy and to revolutionise infrastructural development in Nigeria. To many Nigerians Mr. Godwin Emefiele is an incurable optimist who sees the Nigerian economy as having a very bright future. When ever he has the opportunity, either in Nigeria or abroad, he has drummed it into the ears of all who care to listen that Nigeria possesses all that it requires to earn the title, giant of Africa, the largest economy in the continent. He is a strong advocate of stakeholders in the financial services being proactive in supporting the growth of sectors such as Agriculture, ICT and Infrastructure which have the potentials to strengthen Nigeria’s ability to deal with the challenges that have been brought on by COVID-19, and stimulate the growth of the economy.

The man Godwin Emefiele was born on August 4, 1961 in Lagos State, Nigeria. An indigene of Ika South Local Government Area of Delta State. But all of this has come at a price to his person and family. Several attempts have been made to discourage him. Several spurious allegations were made, his wife was kidnapped, he was betrayed by some loyalist but he remained focus. The CBN under Emefiele was attacked by foreign investors and their media propagandist because the bank denied foreign exchange access to 43 items that can be produced locally. He also faced political pressure from hawks who want to see their candidate replace him. The worry however is will his legacy continue after him? What will become of the rice revolution, will it endure? Time and time will tell. As he celebrates his 60th birthday today, one can only wish Mr. CBN Governor, happy birthday celebration.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

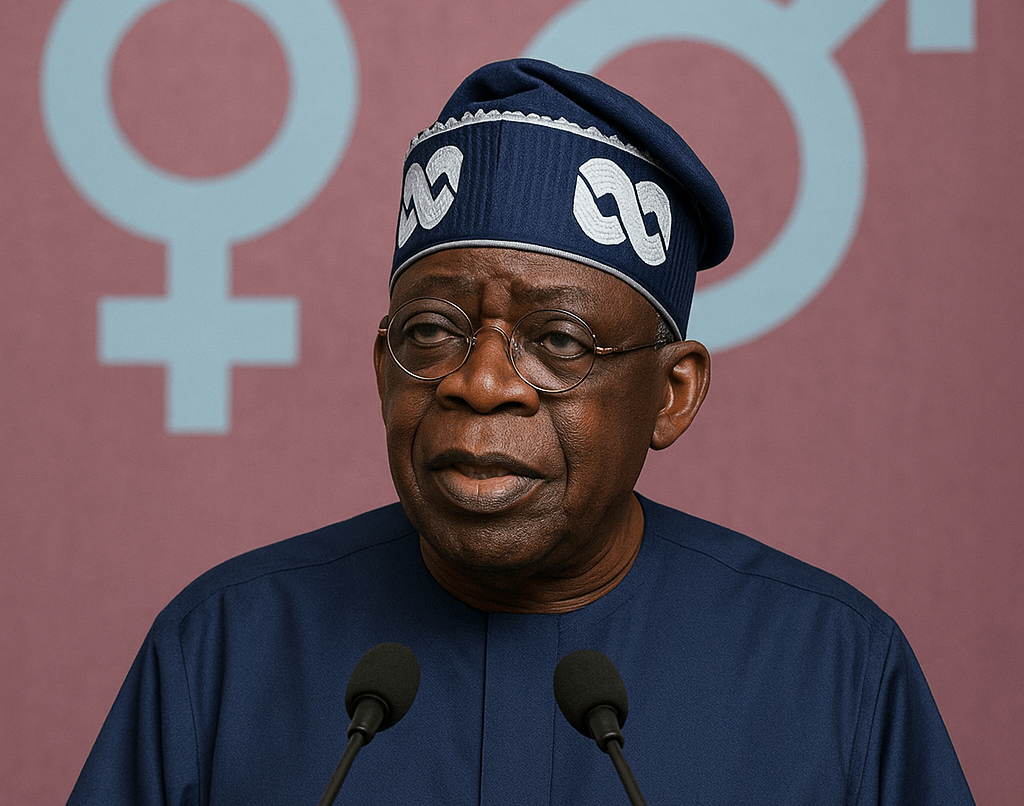

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG