Finance

Stock market records a flattish performance… ASI down 0.3bp

Despite gains in MTNN (+0.3%), BUAFOODS (+0.8%), and FBNH (+1.8%), the domestic equities market was muted today as the NGX-ASI printed at 47,064.82 (previously; 47,066.77) points. As such, YTD return declined marginally to 10.2% while market capitalisation fell ₦1.1m to ₦25.4tn. Trading activity faltered as volume and value traded slid 18.9% and 32.7% respectively to 274.2m units and ₦3.8bn.

Performance of the sectors within our coverage was positive as 4 indices advanced while 2 declined. Leading the gainers’ chart, the Insurance and Oil & Gas indices rose 1.5% and 0.3% respectively due to interest in NEM (+8.4%), AIICO (+1.5%), OANDO (+1.2%), and ETERNA (+4.4%). In the same vein, the AFR-ICT and Consumer Goods indices gained 12bps and 10bps respectively following price uptick in MTNN (+0.3%), BUAFOODS (+0.8%), and FLOURMILL (+4.9%). Meanwhile, sell -pressure on STANBIC (-1.9%), UBA (-0.7%), and WAPCO (-0.4%) dragged the Banking and Industrial Goods indices down by 1.0% and 2bps, respectively.

Investor sentiment, as measured by market breadth, improved to 0.12x from a flat position the prior session as 28 stocks gained, 21 lost while 58 were unchanged. In the next trading session, we expect the market to record mild gain due to improved sentiment.

NGX ASI: 47,064.82 points

Previous ASI: 47,063.28 points

% Day Change: 0.00%

% Y-t-D: 10.18%

Market Cap (N): 25.360 trillion

Volume: 274,206,976

Value (N): 3.82 billion

Deals: 5,331

NGX Top ASI gainers

LEARNAFRICA up +9.70% to close at N1.81

MORISON up +9.55% to close at N2.18

RTBRISCOE up +9.52% to close at N0.46

VERITASKAP up +9.52% to close at N0.23

NASCON up +9.43% to close at N14.50

NGX Top ASI losers

BERGER down – 9.58% to close at N7.55

CHIPLC down – 4.62% to close at N0.62

JAIZBANK down – 4.29% to close at N0.67

INTBREW down – 2.86% to close at N5.10

ETI down – 2.80% to close at N12.15

Top 3 by Volume

ACCESS – 55,397,741

GUINNESS – 16,710,189

JAPAUL – 14,013,920

Top 3 by Value

GUINNESS – N1,162,718,235.50

ACCESS – N576,538,210.30

MTNN – N350,755,675.80

-

Finance2 days ago

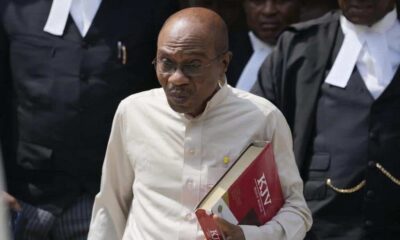

Finance2 days agoBanks hoarded redesigned naira, EFCC witness tells court in ex-CBN governor Emefiele’s trial

-

Finance2 days ago

Finance2 days agoAccess Bank failed in Bidvest Bank acquisition bid, could not meet S. A regulatory requirements

-

Business18 hours ago

Business18 hours agoJumia aims for profit as it fends off Chinese rivals

-

Uncategorized18 hours ago

Uncategorized18 hours agoEcobank Nigeria Launches New Business App for SMEs

-

Economy18 hours ago

Economy18 hours agoFG orders NAFDAC to halt sachet alcohol ban enforcement citing economic, security risks

-

Industry18 hours ago

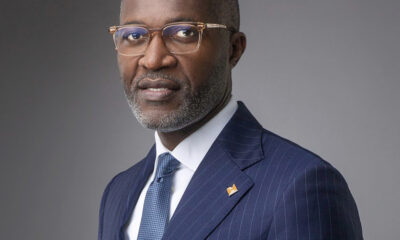

Industry18 hours agoBUA Foods names Isyaku Khalifa Rabiu CO, global procurement

-

Finance18 hours ago

Finance18 hours agoCBN approves $150,000 weekly FX sales to licensed BDC

-

Oil and Gas18 hours ago

Oil and Gas18 hours agoU.S. Energy Agency revises oil price forecast for 2026