Economy

Buhari Presents exit Budget of N20.51trn for 2023 to NASS, debt service of N6.31trn, oil price benchmark $70bpd, daily oil production estimate of 1.69m barrels

President Muhammadu Buhari has presented a budget estimate of N20.51 trillion for 2023 to the joint session of the Senate and the House of Representatives at the National Assembly. A break down of the proposal showed a N2.42 trillion spending by Government-Owned Enterprises. The budget of N20.51trillion is about N750 billion higher than N19.76trillion earlier proposed in the 2023 – 2025 Medium Term Expenditure Framework and Fiscal Strategy Paper. Also the 2023 budget proposal is higher than N17.23 trillion aggregate expenditure for 2022 by N3.28trillion. Addressing the Senators and members of the House of Representatives President Buhari described the 2023 appropriation as a budget of “fiscal sustainability and transition”. He said that the budget “reflects the serious challenges currently facing our country, key reforms necessary to address them, and imperatives to achieve higher, more inclusive, diversified and sustainable growth.” The President said that the principal objective in 2023 is to maintain fiscal stability and ensure a smooth transition to the incoming administration. With the budget, Nigeria will have to borrow N8.80 trillion, almost half of the entire budget size to finance the deficit of N10.78 trillion. The rest monies needed to finance the budget will come from proceeds from sales of national assets. Yet Nigeria will have to spend another N6.31 trillion from the roughly N9 trillion that will be left to service outstanding debts, thereby leaving the government with a meagre sum of N3 trillion that will be easily gulped by fuel subsidy regime.

President Buhari however lowered projection of budget deficit by pegging it at N10.78 trillion against N11.30 trillion proposed in the MTEF/ FSP documents but said that the N10.78 trillion would be funded by projected N8.80 trillion new borrowings and proceeds from privatised assets and others, adding, “We plan to finance the deficit mainly by new borrowings totalling N8.80 trillion, N206.18 billion from Privatisation proceeds and N1.77 trillion drawdowns on bilateral/multilateral loans secured for specific development projects/programmes.” The budget proposal earmarked N3.6trillion to fund fuel subsidy from January to June next year with warning that the subsidy regime must stopped in saving the Nation’s economy from avoidable bleedings on yearly basis. According to the President, critical assumptions and parameters upon which the projected N20.51trillion 2023 budget is based are; Oil price benchmark of $70 per barrel, daily oil production estimate of 1.69 million barrels per day, exchange rate of N435.57 per dollar; projected GDP growth rate of 3.75 per cent and 17.16 per cent inflation rate. Other critical components of the budget are: N744.11billion for Statutory Transfers , N8.27trillion for Non-debt Recurrent Costs, N4.99 trillion for Personnel Costs , N854.8 billion for Pensions and Gratuities of Retirees.

Others are N1.11trillion for Overheads cost, N5.35trillion for Capital Expenditure including the capital component of Statutory Transfers, N6.31 trillion for Debt Service and N247.73 billion as Sinking Fund to retire certain maturing bonds. President Buhari said that based on the parameters, total federally-collectible revenue is estimated at N16.87 trillion in 2023 fiscal year. He said, “total federally distributable revenue is estimated at N11.09 trillion in 2023, while total revenue available to fund the 2023 Federal Budget is estimated at N9.73 trillion. This includes the revenues of 63 Government-Owned Enterprises. Oil revenue is projected at N1.92 trillion, Non-oil taxes are estimated at N2.43 trillion, FGN Independent revenues are projected to be N2.21 trillion. Other revenues total N762 billion, while the retained revenues of the GOEs amount to N2.42 trillion. The 2023 Appropriation Bill aims to maintain the focus of MDAs on the revenue side of the budget and greater attention to internal revenue generation.”

As a way of ending the lingering strike by the Academic Staff Union of Universities ( ASUU) and revitalising Tertiary Institutions in the country , President Buhari disclosed that the government has earmarked a total of N470billion for that purpose, adding that the allocation, though drawn from the government’s constrained resources, was part of its effort to resolve the issue of paralysed activities in public universities. The allocation comes amid the lingering strike in public universities which has left schools closed for over seven months. The striking lecturers have resolved to stay off work until their demands are met. Part of their demands are rehabilitation and revitalisation of universities as well as better welfare for lecturers. According to Buhari, he expects the staff of these institutions to show a better appreciation of the current state of affairs in the country as the federal government is appalled by the crisis that has paralysed activities in the public universities in the country. He said, “The Government notes with dismay the crisis that has paralysed activities in the public universities in the country. We expect the staff of these institutions to show a better appreciation of the current state of affairs in the country. In the determined effort to resolve the issue, we have provided a total of N470.0 billion in the 2023 budget from our constrained resources, for revitalisation and salary enhancements in the tertiary institutions.

“Distinguished Senators and Honourable members, it is instructive to note that today Government alone cannot provide the resources required for funding tertiary education. In most countries, the cost of education is jointly shared between the government and the people, especially at the tertiary level. It is imperative therefore that we introduce a more sustainable model of funding tertiary education. The Government remains committed to the implementation of agreements reached with staff unions within available resources. This is why we have remained resolute that we will not sign any agreement that we would be unable to implement. Individual institutions would be encouraged to keep faith with any agreement reached in due course to ensure stability in the educational sector”, he said. Buhari pledged commitment to the implementation of agreements reached with staff unions within available resources. He said that it is for this reason that his government remained resolute not to sign any agreement that it would be unable to implement, adding that the government is committed to improving the quality of education at other levels. He also pledged to remain committed to the effective implementation of the Safe Schools Policy. He said that for that reason, a total of 15.2 billion has been specifically provided in the 2023 budget to scale up current measures to provide a safer and conducive learning environment in our schools.

Buhari said that constant electricity supply will come to reality in 2025 based on fast improvements being made in that direction particularly with projected additional 7,000 megawatts by 2024. According to him “We have transformed Nigeria’s challenging power sector, through bespoke interventions such as the Siemens Power Program, with the German government under which over 2 billion US Dollars will be invested in the Transmission Grid. We have leveraged over billions of US dollars in concessional and other funds from our partners at the World Bank, International Finance Corporation, African Development Bank, JICA as well as through the Central Bank of Nigeria, working with the Finance Ministry, to support the power sector reforms. The Central Bank has also been impactful in its interventions to roll out over a million meters to on-grid consumers, creating much needed jobs in assembly and installation. Our financing interventions have recently been complemented with the takeover of four electricity distribution companies and the constitution of the Board of the Nigeria Electricity Liability Management Company.

On the generation side, we have made significant investments in and incremental 4,000MW of power generating assets, including Zungeru Hydro, Kashimbila Hydro, Afam III Fast Power, Kudenda Kaduna Power Plant, the Okpai Phase 2 Plant, the Dangote Refinery Power Plant, and others. “Our generation efforts are making the transition from a reliance on oil and diesel, to gas as a transitional fuel, as well as environmentally friendly solar and hydro sources. Under the Energising Education Programme, we have commissioned solar and gas power solutions at Federal Universities and Teaching Hospitals at Kano, Ebonyi, Bauchi and Delta States. Similarly, our Energising Economies Programme have taken clean, sustainable power solutions to the Sabon-Gari Market in Kano, Ariaria Market in Aba, and Sura Shopping Complex in Lagos.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

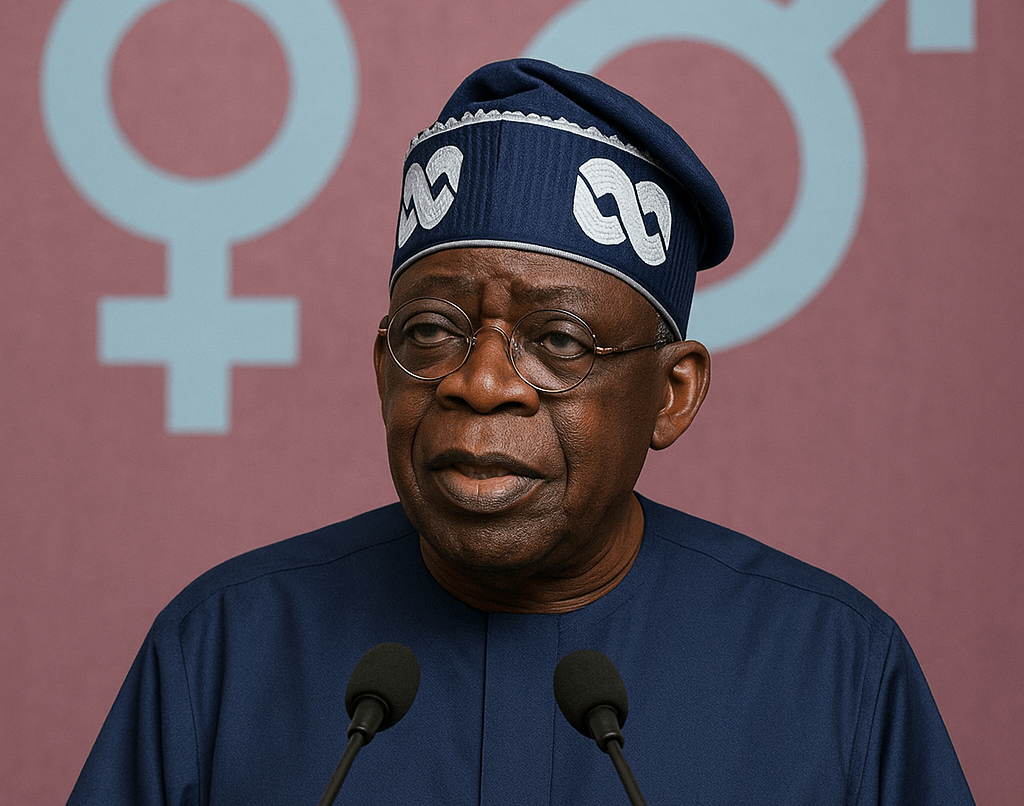

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG