News

FG wipes out N5.57 trn NNPC Debt in fiscal reform, to activate $2.8bn AKK Gas Pipeline for export in 2026

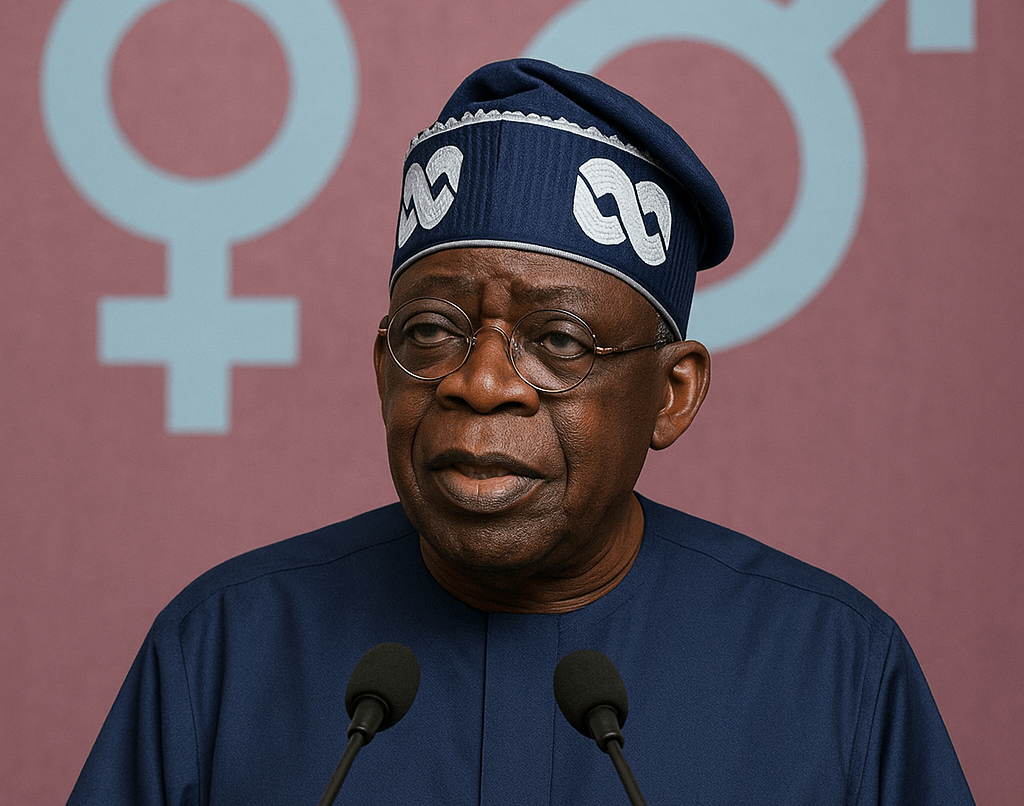

President Bola Tinubu has approved the cancellation of a massive portion of the debts owed by the Nigerian National Petroleum Company Limited (NNPC Ltd) to the Federation Account, wiping out about N5.57 trillion after a reconciliation of records between the two entities just as NNPC Limited would activate its $2.8 billion Ajaokuta-Kaduna-Kano (AKK) pipeline for export early in 2026, its Group CEO Bashir Ojulari said.

The decision was contained in a document prepared by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and presented at the November 2025 meeting of the Federation Account Allocation Committee (FAAC).

The write‑off follows a comprehensive review of NNPC’s outstanding obligations, which had been reported at $1,480,610,652.58 and N6,332,884,316,237.13 for Production Sharing Contracts (PSC), Direct Sale Direct Purchase (DSDP), Revenue Allocation and Miscellaneous Crude Liftings (RA & MCA), and Joint Venture and PSC royalty receivables.

The Presidency has now cleared the bulk of these balances, with the NUPRC confirming that 96 % of the dollar‑denominated debt and 88 % of the naira‑denominated obligations have been “nil‑off” .

The cancellation is part of a broader effort to resolve long‑standing disputes over NNPC’s legacy indebtedness. The NUPRC noted that while the legacy debts have been largely cleared, fresh obligations incurred between January and October 2025 remain outstanding, totaling $56,808,752.32 and N1,021,550,672,578.87 for PSC & MCA liftings and JV royalty receivables respectively.

The commission has already passed the necessary accounting entries to reflect the debt relief in the Federation Account .

The decision has sparked debate over its fiscal impact. While the write‑off provides immediate relief to NNPC, it reduces the distributable revenue pool for the Federation Account, potentially squeezing allocations to states and local governments.

Analysts warn that the move could exacerbate revenue shortfalls at the sub‑national level, especially as the country grapples with rising public debt and fiscal pressures .

The World Bank has previously criticized NNPC for persistent gaps between reported earnings and actual remittances, urging stronger oversight and transparency in the management of oil revenues.

The bank also highlighted that NNPC has been remitting only 50 % of revenue gains from the removal of the Premium Motor Spirit subsidy to the Federation Account, underscoring the need for improved fiscal discipline.

The FAAC sub‑committee has directed NNPC Ltd and audit firm Periscope Consulting, which flagged an alleged $42.37 billion under‑remittance between 2011 and 2017, to meet jointly and harmonize records. This dispute remains unresolved, and the reconciliation process is ongoing .

President Tinubu’s approval to write off $1.42 billion and N5.57 trillion of NNPC’s legacy debt marks a significant step toward settling historical financial disputes, but it also raises concerns about short‑term revenue losses for states and the broader fiscal health of the federation.

Meanwhile the update followed a recent tour of the project by the Minister of State for Petroleum Resources (Gas), Ekperikpe Ekpo, accompanied by Ojulari, and the Company’s Executive Vice President (Gas, Power, and New Energy), Olalekan Ogunleye.

The AKK pipeline, first conceived in 2008, is central to Nigeria’s ambition to leverage its vast gas reserves for economic growth. Its completion could transform the north, where chronic power shortages and a lack of energy infrastructure have stifled manufacturing for decades.

-

News1 day ago

News1 day agoNew tax regime will lead to massive increase in airfares—Air Peace chief Onyema

-

Economy8 hours ago

Economy8 hours agoWhere is Nigeria President?— Media Right

-

News1 day ago

News1 day agoUNIBEN concludes first phase of ITF-SUPA artisan training, empowers 200

-

Economy1 day ago

Economy1 day ago2026 could mark the beginning of a more robust growth phase with tangible improvements in living standards—CPPE

-

Oil and Gas9 hours ago

Oil and Gas9 hours agoCrude oil price rises as investors weigh outcome of Trump–Zelenskiy meeting

-

News8 hours ago

News8 hours agoNNPC targets industrial boom in country’s north as gas pipeline nears completion

-

Stock Market8 hours ago

Stock Market8 hours agoU.S. stock futures flat, silver gains again as investors hope to start 2026 on a roll

-

Finance8 hours ago

Finance8 hours agoCBN offers treasury bill above inflation rate in 2025