Economy

IMF urges FG to reduce fuel subsidy, wind down AMCON’s operation

By Omoh Gabriel

The International Monetary Fund IMF has asked the Federal Government to reduce poorly-targeted fuel subsidies, adopt a rule to set the reference oil price in the budget, and fully operate the Sovereign Wealth Fund as soon as possible. The Fund however, advised that efforts should be intensified to mobilize public support for these reforms.

This was contained in the Funds financial score card on Nigeria weekend at the conclusion of its Article IV consultation with the government.

The IMF however noted that widespread unemployment and poverty in Nigeria remained key challenges for policymakers, and called for renewed efforts to make economic growth more broad-based and inclusive.

It also “underscored the need for the government to improve tax administration, better prioritize public expenditure, strengthen the public financial management, and improve the fiscal framework.”

The report further said “Executive Directors (of IMF) commended the authorities for prudent macroeconomic policies that have underpinned a strong economic performance in recent years and looking ahead supported the authorities’ strategy of consolidating the fiscal position while opening up policy space for needed investment in infrastructure and human capital.

”The Directors considered the current tight monetary stance to be consistent with the authorities’ objective of reducing inflation to single digits. They also took note of the staff’s assessment that the exchange rate in real effective terms is broadly in line with fundamentals. Directors commended the authorities’ success in restoring financial stability after the 2009 banking crisis. In light of this achievement, they recommended winding down the operations of the asset management company to curb moral hazard and fiscal risks.

“Directors welcomed the Central Bank’s commitment to address supervisory and regulatory gaps identified in the Financial Stability Assessment Update, particularly the need to strengthen cross-border supervision and the regime against money laundering and terrorism financing. Directors concurred that wide-ranging reforms are key to make growth more inclusive. They agreed on the importance of supporting sectors with high employment potential, not through protectionist measures or tax incentives but rather with initiatives to improve governance, the investment climate, and competitiveness. Directors welcomed reforms underway in the energy sector, and looked forward to an early passage of the Petroleum Industry Bill which would boost investment, government revenue, and fiscal transparency. They also encouraged the authorities to promote market-based access to credit for small- and medium-sized enterprises. On February 6, 2013, the Executive Board of the International Monetary Fund (IMF) concluded the 2012 Article IV consultation with Nigeria.”

Nigeria’s macroeconomic performance has been broadly positive over the past year. Real gross domestic product (GDP) growth is projected to have decelerated slightly to 6.3 percent, reflecting the effects of the nationwide strike in early 2012, floods in the fourth quarter of 2012, and continued security problems in the north. Annual inflation increased from 10.3 percent (end-of-period) in 2011 to 12.3 percent in 2012, owing mainly to the adjustment of administrative prices of fuel and electricity; large increases in import tariffs on rice and wheat; and the impact of floods in Q3. The external position has strengthened and international reserves rose from US$32.6 billion at end-2011 to US$44 billion at end-2012 (5½ months of prospective imports), driven by sustained high oil prices, stricter administration of the gasoline subsidy regime, and strong portfolio inflows.

The fiscal policy stance was tightened in 2012 and fiscal buffers are being rebuilt. The non-oil primary deficit of the consolidated government is estimated to have narrowed from about 36 percent of non-oil GDP in 2011 to 30.5 percent in 2012, mainly due to expenditure restraint. Monetary policy remained tight in 2012 in response to inflationary pressures. The Central Bank kept its policy rate unchanged during the year but raised the cash reserve requirement for banks from 8 percent to 12 percent and lowered allowable open foreign exchange position for banks. Financial soundness indicators point to continued improvements in the health of the banking system.

In 2013, growth is expected to recover to above seven percent. Inflation is projected to decline below 10 percent, supported by the tight monetary policy stance and ongoing fiscal consolidation. The key downside risks are a large drop in world oil prices; and slow progress in building consensus around key fiscal reforms.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

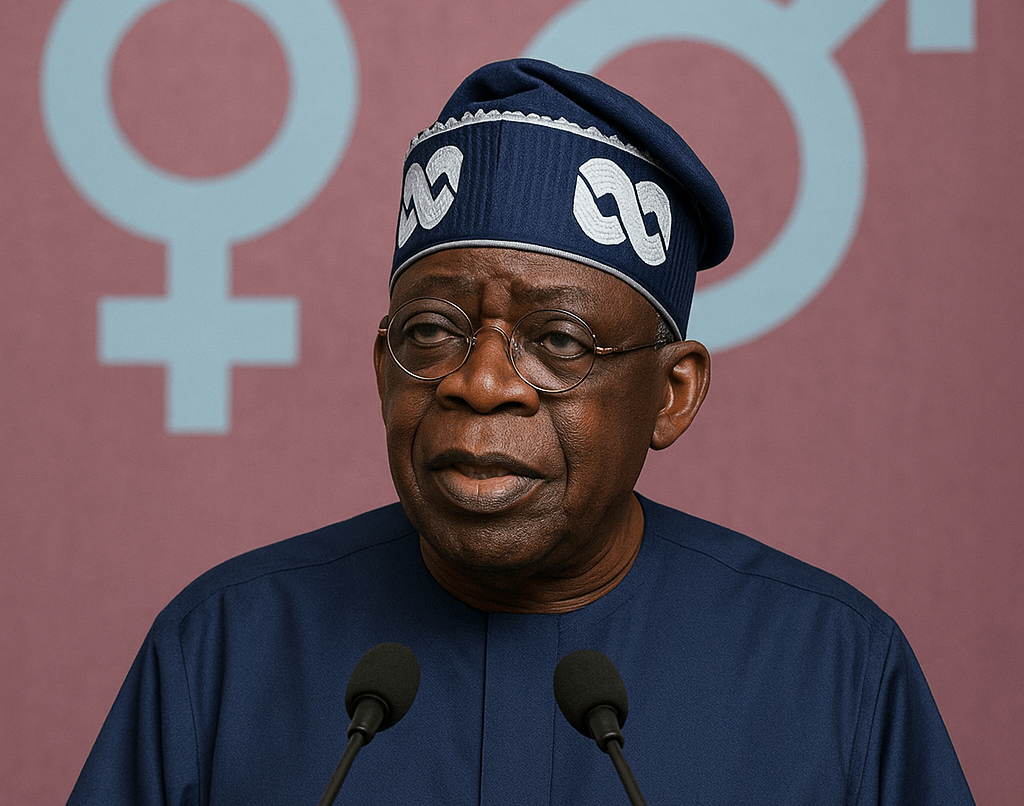

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG

You must be logged in to post a comment Login