Economy

Aba integrated power project to play a critical role in facilitating industrialisation, trade, Nigeria gets 60% of $30bn Afreximbank oil & gas funding

In the face of dwindling international funding for hydrocarbon projects in Africa, the African Export-Import Bank, AfreximBank, on Wednesday, said that it has become the largest financier of oil and gas projects on the continent. Meanwhile,Afreximbank said thatthe 141 MW Aba Integrated Power Project (Aba IPP), its financed project, was officially commissioned in Abia State by the Vice President of the Federal Republic of Nigeria, H.E Kashim Shettima. The bank in a statement said “a first of its kind in Nigeria, the Aba IPP is a pioneering initiative capable of generating and distributing 141 MW of its produced power across nine local government areas (LGAs) within the Aba ring-fenced zone. Adequate distribution of energy is a cornerstone for national development, playing a critical role in facilitating industrialisation and trade. Recognising the challenges in the sector such as inadequate liquidity, high level of debt, and a lack of profitability, Afreximbank continues to support energy projects on the continent and has committed in excess of US$ 4.6 billion to Africa’s power sector since inception. With approximately USD 900 million of funding in Nigeria, the Bank is one of the leading financiers in the Nigerian power sector. In 2021, Afreximbank signed a US$50 million term loan facility with Geometric Power Limited to support the completion of the generation and distribution infrastructure, commissioning of the gas supply pipeline and commencement of operations of the project.

On oil and Gas The bank said it has so far spent $30 billion to fund projects in the industry with Nigeria getting 60 per cent of the funding. Speaking at the National Oil Companies Forum at the ongoing Nigeria International Energy Summit, NIES, in Abuja, President, Afreximbank, Professor Benedict Oramah said Africa has to find innovative solutions to its huge energy deficit Represented by Mr. Haytham ElMaayergi, Executive Vice President, Global Trade Bank, Prof. Oramah lamented that it was incomprehensible that in a continent with abundant oil, gas, solar hydro resources, the bulk of the population still lacks access to reliable and affordable energy. He said that the continent lacks extensive traditional energy infrastructure, but stressed that this presents an opportunity for leapfrogging in a more efficient way to renewable technology. “Our aspiration in the area of energy security and energy transition will remain aspiration unless we have access to adequate funding resources that we control. With a lot of international banks withdrawing funding out of the oil and gas sector, the investment in the industry has become severely limited with the corresponding impact on exploration and production. Afreximbank has intervened in a big way, quickly becoming the largest financier of oil and gas deals in the continent. The support provided to the sector by the bank is in excess of 30 billion US dollars. Nigeria has been one of the largest beneficiaries accounting for almost 60 percent of the total funding of the sector. And it’s important to the point that afreximbank has been able to make those modest contributions in the oil and gas sector because the bank is predominantly African in ownership and control”, he stated.

He said that Afreximbank would be managing the proposed Africa Energy Bank to ensure its best chance of success. “The strategic goal of the Africa Energy Bank is to play a leadership role in shaping the energy landscape in Africa through strategic partnership with proven African and international financial institutions and investors and also to provide sustainable financing in this area of the oil and gas sector. The Africa energy bank will need considerable support to get off the ground. We will need support from member states to achieve the level of capitalisation that is adequate to support the energy sector”, he added.

On Aba Prof. Benedict Oramah, said “Afreximbank is proud to be part of this great milestone achievement in Nigeria. The 141MW Aba IPP underscores what can be achieved when public and private sector stakeholders join forces to impact humanity. As champions of trade and industrialisation initiatives in Africa, we believe that it is projects like this embedded IPP that will catalyse trade and economic development in Nigeria and across the region.” The Aba IPP is unique as it is the only electricity company in Nigeria that is fully vertically integrated with embedded generation and distribution capabilities. This model ensures the Aba IPP can supply power directly to its immediate community, prioritising local needs and distributing surplus power to Nigeria’s national power grid. This ground-breaking approach ensures constant power supply in the ring-fenced area and addressing the challenges associated with the national power grid. Furthermore, the integrated structure fosters value creation through improved cost management at various stages in the energy value chain: generation, distribution, and collection.

The Aba IPP is equipped with renowned world class infrastructure including three GE LM6000 Gas turbines, with a capacity to produce up to 47MW each. The power plant is also equipped with a 27km gas pipeline to ensure consistent fuel supply, three rehabilitated distribution substations, five new additional substations and 140km of 33kV/11kV lines using fibre optic cables for seamless data communication. Strategically positioned in the industrial South-Eastern Nigeria, the Aba metropolis is one of the most commercial areas in West Africa, renowned for its cottage and small-scale industries specialising in the craftsmanship of leather goods, fabrics and related services. In addition to increased power supply and reliability, the Aba IPP is expected to enhance industrialisation efforts and increase production of small and medium-scale enterprises, as well as local industries. According to Geometric power, over 370,000 direct and indirect jobs would be created during the operational phase of the project. In addition, there are significant indirect benefits for the supporting industries including the development of road infrastructure, improvement in local services including enhanced water supply, schools and healthcare facilities, a boost in agricultural productivity due to a more reliable power supply, as well as increased support for rural electrification programs and enhanced tourism and leisure opportunities.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

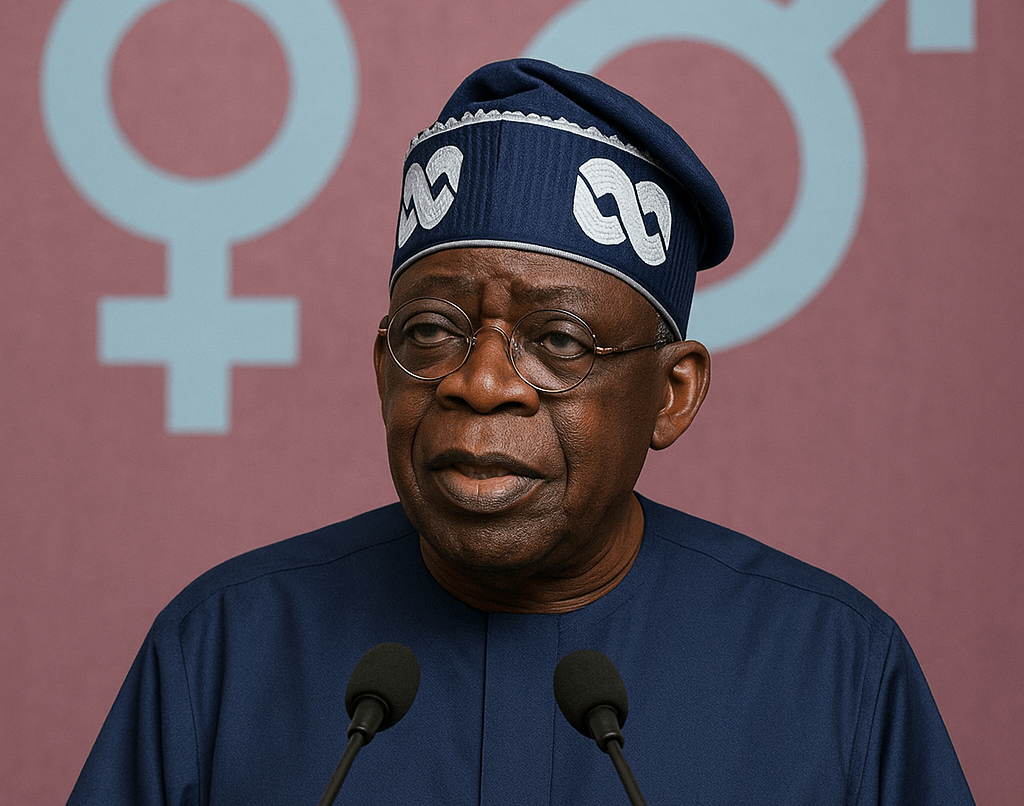

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG