Economy

eNaira carries risk of cyber security, financial integrity—IMF

Jack Ree an economist in the IMF African Department has said that the eNaira Like digital currencies elsewhere carries risks for monetary policy implementation, cyber security, operational resilience, and financial integrity and stability. Introducing the eNaira in the IMF country focus article titled “Five Observations on Nigeria’s Central Bank Digital Currency” he said “For example, eNaira wallets may be perceived, or even effectively function, as a deposit at the central bank, which may reduce demand for deposits in commercial banks. Relying as it does on digital technology, there is a need to manage cybersecurity and operational risks associated with the eNaira”. Other countries and regions, such as China and the Eastern Caribbean Currency Union, have been conducting CBDC pilots with a subset of their citizens. Given the size and complexity of Nigeria’seconomy, this launch is drawing substantial interest from the outside world—including from central banks.

The article asked

What is eNaira?

Like coins or cash, the eNaira is a liability of the CBN. The eNaira uses the same blockchain technology as Bitcoin or Ethereum and, like them, the eNaira is stored in digital wallets and can be used for payment transactions; and it can be transferred digitally and at virtually no cost to anyone in the world with an eNaira wallet. There are, however, important differences. First, the eNaira features stringent access right controls by the central bank. Second, unlike these crypto-assets, the eNaira is not a financial asset in itself but a digital form of a national currency and draws its value from the physical naira, to which it is pegged at parity.

Why did Nigeria introduce eNaira?

According to the CBN, the eNaira is envisaged to bring multiple benefits, which are expected to materialize gradually as the eNaira becomes more widespread and is supported by a robust regulatory system. Key benefits include the following: increase in financial inclusion. For now, the eNaira wallet is provided only to people with bank accounts, but its coverage is expected to eventually expand to anyone with a mobile phone even if they do not have a bank account. A large number of people do not have bank accounts (38 million people; 36 percent of the adult population), and allowing those of them with a mobile phone to have access to the eNaira would increase financial inclusion and facilitate more direct and effective implementation of social transfers programs. It is expected that the move would enable up to 90 percent of population to use the eNaira.

Facilitation of remittances. Nigeria is among the key remittance destinations in sub-Saharan Africa, with remittance receipts amounting to $24 billion in 2019. Remittances typically are made through international money transfer operators (e.g., Western Union) with fees ranging from 1 percent to 5 percent of the value of the transaction. The eNaira is expected to lower remittance transfer costs, making it easier for the Nigerian diaspora to remit funds to Nigeria by obtaining eNaira from international money transfer operators and transferring them to recipients in Nigeria by wallet-to-wallet transfers free of charge. Exchange rate reforms, including a unified market-clearing rate, that reduce the gap between official and parallel market exchange rates would enhance the incentives for using eNaira wallets to send remittances.

Reduced informality. Nigeria has a large informal economy, with transactions and employment equivalent, respectively, to over half of GDP and 80 percent of employment. The eNaira is account-based, and transactions are in principle fully traceable, unlike token-based crypto asset transactions. Once the eNaira becomes more widespread and embedded into the economy, it may bring greater transparency to informal payments and strengthen the tax base. Informal and formal businesses may also benefit if eNaira adoption enhances consumption through greater financial inclusion.

What are the authorities doing to mitigate the potential risks?

The authorities have taken measures to manage the risks. The transfer of funds from bank deposits to eNaira wallets is subject to daily transactions and balance limits to mitigate risks of diminishing the roles of banks and other financial institutions. Financial integrity risks, such as those arising from the potential use of the eNaira for monetary laundering, are mitigated by using a tiered identity verification system and applying more stringent controls to relatively less verified users. For example, for now only people with a bank verification number can open a wallet, but over time coverage will be expanded to people with registered SIM cards and to those with mobile phones but no ID numbers. The latter categories of holders would be subject to tighter transactions and balance limits. Even so, wallet holders who meet the highest identity verification standards cannot hold more than 5 million naira (about $12,200) each in their eNaira wallets. To address cybersecurity risk, regular IT security assessments are expected to be conducted.

What can the IMF do?

The IMF remains available to help with technical assistance and policy advice. The IMF’s Monetary and Capital Markets Department has been involved in the eNaira rollout process, including by providing reviews of the product design. The 2021 IMF Article IV mission emphasised the need for monitoring risks and macro-financial impacts associated with a central bank digital currency. [1] The IMF is ready to collaborate with the authorities on data analysis, cross-country studies, sharing the eNaira experience with other countries, and discussing further evolution of the eNaira including its design, regulatory framework, and other aspects.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

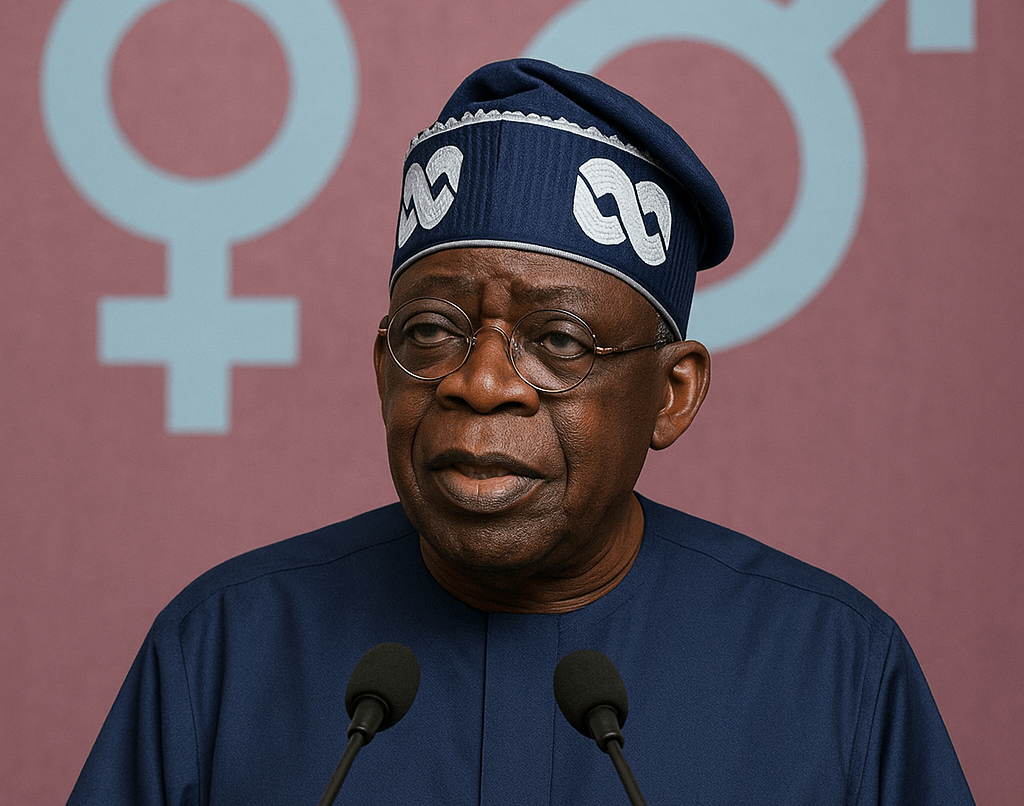

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News4 days ago

News4 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG