Economy

FG interested in state power projects – Fashola

Minister of Power, Works and Housing Mr Babatunde Fashola has said that the Federal Government is in favour of state governments developing their own power projects to support development and supply of incremental power. Fashola stated the position of the Federal Government at a meeting of the National Council on Power (NACOP) in Jos. He said “I heard statements to the effect that Federal Government should allow the states to develop their own power projects. The truth is that Federal government is not standing on the way of any state; the laws do not stand in the way of any state to develop power projects.

“Because as governor, we built seven power plants, government did not stop us; what we could not do is to do commercial distribution which the law actually allows under license through Nigerian Electricity Regulatory Commission (NERC).” Fashola said that the theme of meeting, “Completing Power Sector Reforms”, provided opportunity to share with representatives of state governments, other participants what the Power Sector Recovery Programme (PSRC) was about. The minister said some of the reform actions contained in the PSRC were already being undertaken at the Federal Government’s level.

He, however, said that there were other areas of the reform where progress in the sector would be defined by what happened at the state and local government. He called on the state governments to champion advocacy in some areas of the reforms process in their states to further realise incremental power programme of the Federal Government. Fashola listed some of the advocacy required from states governments to their citizens to include: “State authorities should ensure that their residents comply with safety standard on building by not building on the right of way of 332/ 133, 33 and 11KVA lines.

“States can also help by leading the advocacy for the residents to pay for the energy they fairly believe that they have consumed, while we continue to work to resolve the metering issues and estimated billing. States should lead the advocacy for people to stop bypassing meters and stealing energy; energy theft happens in the municipal levels, not in the senate, not in the villa or the house of reps.” The minister urged the states to consider asking their attorney generals to review the financial jurisdiction limits of their various magistrates and area courts so that they could be able to try cases related to energy theft.

Fashola also said it was important that states played significant roles in resolving land disputes on construction of power projects. According to him, despite the earlier call for the reversal of privatisation of the sector, significant progress was being recorded in the sector.

“Some people had called for the cancellation of the privatisation; I will not support that, however, there are some challenges in the sector. “Four years into post privatisation is a transition period and so, more work, therefore, needs to be done before the expected benefits can come to fruition.

“Four years is not enough to change what we could not do in 60 years and expect rapid result in four years this why we developed Power Sector Recovery Programme (PSRP) which is a set of policies, programmes and actions.”

He said that these were aimed at solving the generation problem, transmission, distribution, metering, estimated billing, liquidity, energy theft safety and other challenges. Fashola said that there was increase in generation of up to 7,001 megawatts on September 12, while transmission recorded 6,700 mega watts and distribution up to 4, 600. He said that the N701 billion payment assurance guarantee fund was also responsible for the rise in power generation. “Those that produce power are now sure that they will get paid, those who supply them gas are now sure that they get their money back.

“The banks who lend them money now know that they will get their money back. Power plants owners have started switching on power plants that they have completed that were idle.”

Earlier, Chairman, Senate Committee on Power, Sen Eyinnaya Abaribe, had expressed confidence that NACOP would further evolve steps to improve the sector. He said it was important to acknowledge and fully implement the laws regulating the powers sector. The minister said that the National Assembly would continue to support the sector to improve within the ambit of the law.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

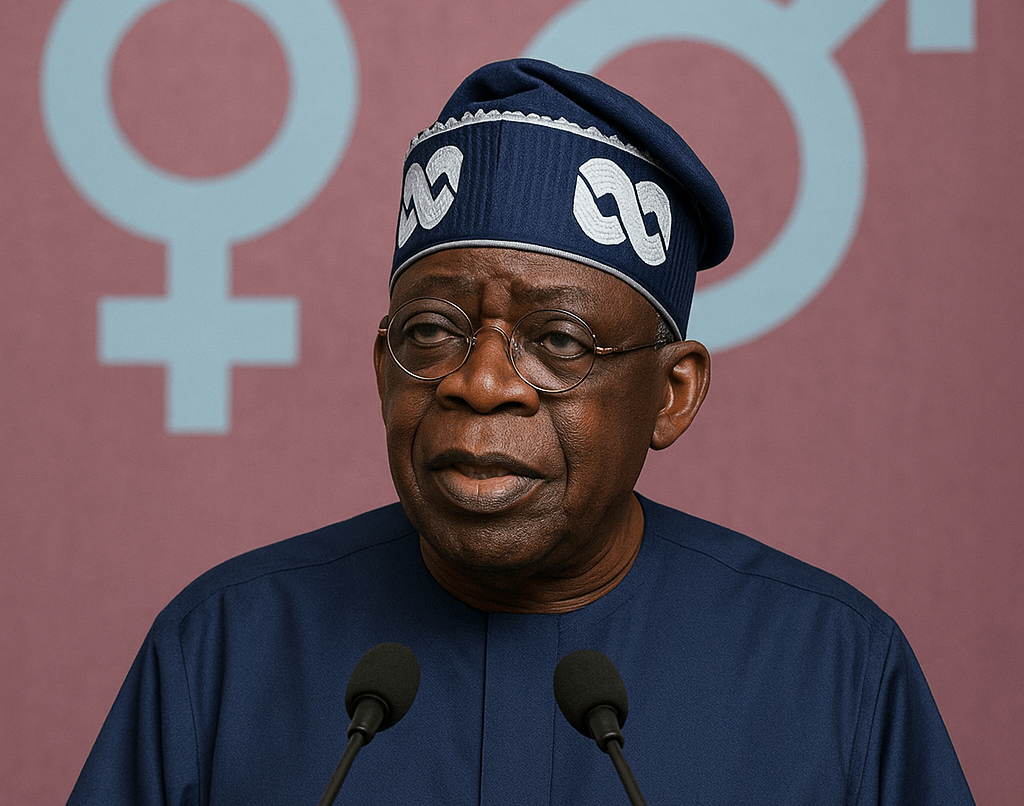

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG