Economy

Leasing in Nigeria: An hidden engine for inclusive growth

By Dr. Olasupo Olusi

Introduction

As Nigeria works to stabilize its economy amid elevated inflation, tight credit conditions, and evolving business pressures, leasing has emerged as a powerful yet underused tool to fuel enterprise growth and industrial productivity. Lease financing gives businesses, particularly small and medium enterprises, access to essential equipment and capital assets for a set period through structured and predictable payments without the burden of immediate ownership. In today’s climate, where flexibility and financial discipline are critical, leasing offers a practical path to risk mitigation, sustained business operations and inclusive economic growth. Despite its promise, leasing remains out of reach for many Nigerian businesses not because it lacks relevance but because of limited awareness, uneven access, and underdeveloped support systems.

Globally, lease financing has proven to be a reliable driver of financial inclusion and productive investment. It enables businesses to acquire essential tools and machinery without the need for substantial collateral or the burden of high-interest loans. In Nigeria, where more than 40 million micro, small, and medium enterprises struggle with limited access to finance and face over ₦13 trillion in unmet credit demand, leasing offers a scalable and practical solution to one of the country’s most persistent development challenges. Capturing even a fraction of this demand could unlock a ₦3 to ₦4 trillion market opportunity, catalyze investment in equipment, boost productivity, and accelerate formalization across Nigeria’s most dynamic sectors.

In 2024, the total value of leases in Nigeria reached ₦5.16 trillion, a 23 percent increase over the previous year. Demand continues to rise across key sectors, including transport and logistics, oil and gas, manufacturing, and agriculture. Yet this growth has not translated into broad-based access. Leasing remains concentrated among large corporates, while MSMEs continue to face barriers to entry. This is not unique to Nigeria. Across Africa, leasing remains underdeveloped relative to global benchmarks. In 2022, Africa accounted for only 0.3 percent of the world’s $1.47 trillion leasing volume. Even among Africa’s top performers, Morocco leads with an average lease penetration rate of just 1.10 percent between 2019 and 2021, followed by South Africa at 0.71 percent, while Nigeria lags at 0.185 percent. These numbers highlight the continent’s untapped potential for asset financing and enterprise growth. For Nigeria to unlock the full benefits of leasing, it must deliberately extend access to MSMEs and underserved sectors. This will take more than market momentum. It requires a strong, supportive legal and institutional framework that builds trust, standardization, and accessibility.

Strengthening the Legal and Institutional Framework

Nigeria has made commendable progress in strengthening the legal foundation of its leasing industry. The enactment of the Equipment Leasing Act (ELA) in 2015 and the establishment of the Equipment Leasing Registration Authority (ELRA) in 2023 introduced much-needed structure, enforceability, and transparency. ELRA’s reforms, particularly in contract registration, licensing, and regulatory oversight, are not just bureaucratic milestones. They established the framework for a more reliable and investable leasing environment. What is most encouraging is that these reforms are dynamic and responsive to market needs. ELRA’s digital registration portal has streamlined contract processing, reducing registration time from weeks to days while enhancing legal enforceability. This digitization signals a broader shift toward ease of doing business that makes Nigeria more competitive regionally. Critically, it has worked with the judiciary to build understanding of leasing structures and enforcement mechanisms, recognizing that sustained growth demands more than laws on paper. It requires institutional understanding, coordination, and coherence across all market participants. Complementing these efforts are the contributions of industry groups like the Equipment Leasing Association of Nigeria (ELAN), which continues to advocate for long-term financing access, simplified tax frameworks, and MSME integration. Yet even with these advances, legal and institutional reforms alone cannot unlock the full potential of leasing Building a functional and inclusive leasing ecosystem requires Nigeria to activate key market actors. Commercial banks must provide the capital that powers leasing portfolios. Insurance providers are critical for de-risking transactions and protecting leased assets. Original equipment manufacturers can drive demand by offering vendor financing, residual value guarantees, and after-sales support. Together these players form the link between policy and practice, ensuring that leasing is not only legally viable but also commercially scalable.

Tackling the Economic Realities: Beyond Legal Reform

Beyond regulatory reform, Nigeria must confront the economic realities that determine whether leasing can deliver meaningful impact. Foreign exchange volatility stands as perhaps the most immediate barrier, given that imported capital equipment dominates most lease portfolios. When the naira weakens unexpectedly, a manufacturing lease that seemed affordable can suddenly become prohibitive, forcing businesses to either abandon expansion plans or accept substandard equipment that compromises productivity. This unpredictability, compounded by scarce hedging options, creates a climate where neither lessors nor lessees can plan with confidence. The result is a cautious market that underinvests in the quality assets Nigeria’s economy desperately needs.

Tax treatment presents another significant barrier that requires immediate attention. While Nigeria’s framework allows for deductions on lease payments and accelerated depreciation, equipment leasing, except for agricultural purposes, remains subject to VAT as it is classified as a supply of service under the VAT Act. The 2025 Tax Reform Bills aim to streamline tax administration and reduce compliance burdens, but they do not currently exempt equipment leasing from VAT. The reforms may, however, pave the way for clearer guidance and more consistent application, particularly around imported leases where ambiguity has led to double taxation and compliance challenges. Addressing these issues through regulatory clarity and guidelines would enhance market confidence and reduce friction.

Confronting these barriers is critical to unlocking leasing’s full potential. Tax clarity, improved access to foreign exchange, and incentives for local production of leasing-grade equipment would reduce market risk, lower costs, and improve uptake across the economy. These reforms would not only strengthen the leasing ecosystem but also create the conditions for leasing to become a mainstream financing option for Nigerian businesses of all sizes.

More importantly, they would open the door for broader inclusion. By making leasing more affordable and accessible, these reforms would help extend opportunities to women- and youth-led enterprises that are often excluded from traditional finance due to lack of collateral, limited credit histories, or informal structures. With deliberate design, leasing can become a powerful tool for inclusive growth, providing underserved groups with access to productive assets without the burden of ownership.

Government and development finance institutions can play a catalytic role by providing credit guarantee schemes, offering tax incentives for inclusive leasing, and integrating leasing into broader MSME and entrepreneurship programs. Institutions like ELRA and ELAN are well positioned to embed these priorities into policy and practice, ensuring that leasing serves not just as a financial tool but as a driver of inclusive economic transformation. This vision for inclusive leasing is not theoretical. Nigeria has already demonstrated what is possible through LECON Finance Company.

BOI Leasing (LECON): A Public Model for Market Transformation

Leasing has long been part of Nigeria’s industrial development agenda, with roots dating back to 1989 when LECON Finance Company emerged under NIDB, now BOI. The experience of LECON, the leasing subsidiary of the Bank of Industry, shows what is possible when reform, institutional capacity, and development finance align. LECON remains Nigeria’s oldest and most deliberate effort to institutionalize development-focused leasing. What sets it apart is not just its longevity but its commitment to expanding access in sectors often overlooked by conventional finance, especially MSMEs.

Over the past three decades, LECON has financed more than 230 projects across critical areas of the economy. It has helped smallholder farmers acquire mechanized equipment, supported schools in acquiring equipment that enhances learning, and enabled healthcare providers to modernize infrastructure. In manufacturing, it has funded machinery that boosts competitiveness. In transport and logistics, it has facilitated fleet expansion that strengthens supply chain efficiency.

LECON’s impact goes beyond disbursing leases. It has served as a catalyst, deepening Nigeria’s leasing ecosystem and illustrating what structured, development-focused leasing can achieve. Through competitively priced, asset-backed leases paired with advisory services, LECON has lowered barriers for MSMEs while modeling the best practices in risk management, contract design, and sector targeting. Backed by the Bank of Industry and driven by a development finance mandate, it has reached enterprises that would otherwise remain excluded. Its consistent A– credit rating from Agusto & Co reflects sound institutional governance and financial health. More importantly, LECON has helped legitimize leasing in Nigeria. It has proven that the model can be responsible, commercially viable, and developmentally impactful. Its work has moved leasing from the margins of finance to the center of national economic strategy. LECON’s success shows what is possible when leasing is purposefully aligned with national development priorities. The task ahead is to build on this foundation and scale leasing to meet emerging needs in green, agricultural, and digital transformation — areas where it can drive inclusive and sustainable growth.

Expanding Leasing’s Role in Green, Agro, and Digital Sectors

As Nigeria advances toward a greener, more digital, and inclusive economy, leasing presents an opportunity to accelerate transformation across key sectors. Green leasing, targeting solar systems, electric vehicles, compressed natural gas vehicles, and other energy-efficient systems, can reinforce the country’s climate commitments while reducing operational costs for businesses. The upfront cost of a commercial solar installation, for instance, can be prohibitive for SMEs, but leasing makes clean energy accessible with immediate cost savings on electricity bills. In agriculture, leasing modern machinery can boost productivity and reduce post-harvest losses that currently waste up to 50% of some crops, according to Nigerian Stored Products Research Institute (NSPRI). Tractors, harvesters, and processing equipment that cost millions of naira upfront become accessible through lease arrangements tailored to agricultural cycles and seasonal income patterns. Micro-leasing smartphones, POS devices, and last-mile delivery tools can empower youth-led businesses, gig workers, and informal traders. A motorcycle for delivery services, costing an average of ₦500,000 upfront, becomes accessible through weekly payments that align with income generation, enabling economic participation for those previously excluded by capital requirements.

A Coordinated Strategy for National Impact

Seizing these opportunities calls for more than isolated efforts. It requires a clear national plan to make leasing a central part of Nigeria’s development finance system. This includes updating and harmonizing laws and regulations across all states, linking leasing to MSME support programs, and building strong partnerships between government and the private sector to attract more investment.

It also means creating policies that encourage local production of equipment and support digital solutions that can make leasing more affordable and easier to access. Technology, especially fintech platforms, can lower costs, improve credit checks, and help leasing reach more small businesses.

Conclusion – The Time to Act on Leasing is Now Leasing is not just a tool for today’s challenges. It is a lever for tomorrow’s prosperity. With the right policies, partnerships, and institutional will, leasing can move from a niche practice to a national engine for inclusive growth and shared prosperity. The foundation is in place through legal reforms and institutional development. The market opportunity is clear and compelling. The development impact is evident in models like LECON and the rise of digital innovations. What is needed now is coordinated action across government, the private sector, and development partners to address the specific barriers that hold leasing back, including foreign exchange volatility, tax treatment, and access limitations. The time to act is now. The opportunity is large, but the need is greater. Nigeria’s economic transformation depends on unlocking the productive power enterprises.

Remember: “why own it, when you can lease it?”

* Dr. Olasupo Olusi is the Managing Director/CEO Bank of Industry Limited

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

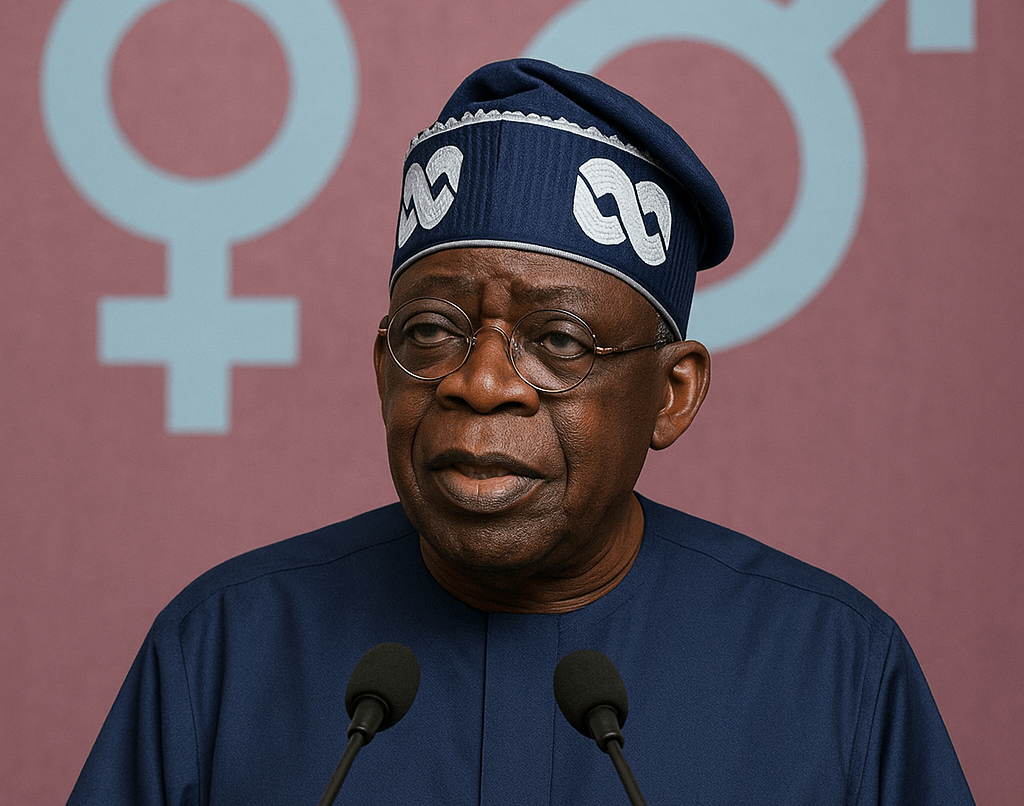

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG