News

Nigeria crude sells as OPEC’s war on oil overhang starts to bear fruit

Trading giant Vitol said it has has sold millions of barrels of Nigerian crude oil from storage in South Africa’s Saldanha Bay, according to oil traders, with cargoes sailing for Taiwan, India, the United States and Europe.

According to international media report France’s Total has offered a further two million barrels of Nigerian Escravos oil from its own Saldanha Bay storage tanks, while sources said trader Mercuria had also been offering oil from storage. It will be recalled that in the recent past tonnes of Nigeria crude were on the high seas looking for buyers.

But this time around, Nigeria’s new loading programmes are finding buyers at a reasonable pace – in stark contrast to the past two years, when any sales from storage put immense downward pressure on prices for newly loaded cargoes.

The new trend indicate that OPEC appears to be slowly winning the battle against a global overhang of crude and oil products as inventories in onshore and floating storage decline. The price of oil may not reflect this just yet, as Brent crude futures are struggling to recover its losses for the year to date and break above $55 a barrel.

But there is no doubt that stocks are falling around the world, from Saldanha Bay in South Africa, to the Caribbean. A persistent glut of Nigerian oil is easing and even Iran has liquidated the amount of crude held in floating storage.

The Organisation of the Petroleum Exporting Countries explicitly said a joint deal with non-OPEC producers to cut some 1.8 million bpd in the first half of 2017 was aimed at slashing an excess of around 300 million barrels of crude and petroleum products in OECD stocks.

“Across the first quarter of the year, crude stocks built by much less than they did in the first quarter of last year even though refinery maintenance globally was much heavier,” Energy Aspects analyst Richard Mallinson said. Iran has sold all the oil it had stored for years at sea and Tehran is now struggling to keep exports growing as it grapples with production constraints. Nordic bank SEB said global oil inventories in weekly data have dropped by 42 million barrels in the last four weeks.

“Rising U.S. crude oil stocks have created some confusion so far this year, but they are a function of reduced U.S. refining activity on the one hand and U.S. crude oil imports on the other,” SEB said.

Mallinson said OPEC ministers meeting in late May will not have a full picture of world stocks due to a lag in reporting from major agencies including the International Energy Agency.

“It is going to take some time of all of the pieces of that inventory picture to become clearer.”

Stocks of oil products are also steadily drawing down. According to consultants FGE, total main product stocks levels in the United States, Amsterdam-Rotterdam-Antwerp independent storage and Singapore and Japan have declined by 6.5 million barrels, in the week to March 13 to 631 million barrels.

The weekly data hit an all-time high of just over 679 million barrels in February 2016, FGE said. If the declines continue, FGE said global product stocks could hit the top of the 10-year range, or 611 million barrels, in just three weeks. Still, they cautioned that much of the product strength was seasonal, and related to maintenance shutdowns that also diminished consumption of crude oil.

This bullishness towards oil products has seen huge amounts of gasoline leaving Europe, and has hindered diesel shipments into the region, which has boosted margins and encouraged refineries to run as quickly as they can. Still, Hamza Khan, head of commodities strategy with Dutch bank ING, said normal seasonal draws on oil products, at the tail end of refinery maintenance season, could be creating a mirage of a tight market.

“Is this due to the reasonable cuts? Or is it due to seasonal draws on crude?” Khan said, adding that with Asian refineries in their month of heavy maintenance, cleared cargoes from storage may not have been processed yet.

“The key question is whether it’s being consumed or whether it’s pushed into somewhere else,” he said.

In the United States “refineries are already running at 91 percent of capacity, how much more crude can they burn?”

News

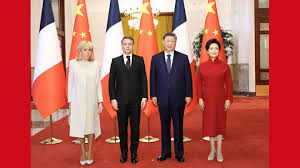

Nigeria–China tech deal to boost jobs, skills, local opportunities

A new technology transfer agreement between the Nigeria–China Strategic Partnership (NCSP) and the Presidential Implementation Committee on Technology Transfer (PICTT) is expected to open more job opportunities, improve local skills, and expand access to advanced technology for ordinary Nigerians.

In a press statement reaching Vanguard on Friday, the MoU aims to strengthen industrial development, support local content, and create clearer pathways for Nigerians to benefit from China’s growing investments in the country.

PICTT Chairman, Dr Dahiru Mohammed, said the partnership will immediately begin coordinated programmes that support local participation in infrastructure and industrial projects.

Special Adviser to the President on Industry, Trade and Investment, Mr John Uwajumogu, said the deal will help attract high value investments that can stimulate job creation and strengthen Nigeria’s economy.

NCSP Head of International Relations, Ms Judy Melifonwu, highlighted that Nigerians stand to gain from expanded STEM scholarships, technical training, access to modern technology, and collaboration across key sectors including steel, agriculture, automobile parks, and cultural industries.

The NCSP Director-General reaffirmed the organisation’s commitment to measurable results, noting that the partnership with PICTT will prioritise initiatives that deliver direct national impact.

The MoU signals a new phase of Nigeria–China cooperation focused on practical delivery, local content, and opportunities that improve everyday livelihoods.

News

EU hits Meta with antitrust probe over plans to block AI rivals from WhatsApp

EU regulators launched an antitrust investigation into Meta Platforms on Thursday over its rollout of artificial intelligence features in its WhatsApp messenger that would block rivals, hardening Europe’s already tough stance on Big Tech. The move, reported earlier by Reuters and the Financial Times, is the latest action by European Union regulators against large technology firms such as Amazon and Alphabet’s Google as the bloc seeks to balance support for the sector with efforts to curb its expanding influence.

Europe’s tough stance – a marked contrast to more lenient U.S. regulation – has sparked an industry pushback, particularly by U.S. tech titans, and led to criticism from the administration of U. S. President Donald Trump. The European Commission said that the investigation will look into Meta’s new policy that would limit other AI providers’ access to WhatsApp, a potential boost for its own Meta AI system integrated into the platform earlier this year.

EU antitrust chief Teresa Ribera said the move was to prevent dominant firms from “abusing their power to crowd out innovative competitors”. She added interim measures could be imposed to block Meta’s new WhatsApp AI policy rollout. “AI markets are booming in Europe and beyond,” she said. This is why we are investigating if Meta’s new policy might be illegal under competition rules, and whether we should act quickly to prevent any possible irreparable harm to competition in the AI space.”

A WhatsApp spokesperson called the claims “baseless”, adding that the emergence of chatbots on its platforms had put a “strain on our systems that they were not designed to support”, a reference to AI systems from other providers. “Still, the AI space is highly competitive and people have access to the services of their choice in any number of ways, including app stores, search engines, email services, partnership integrations, and operating systems.” The EU was the first in the world to establish a comprehensive legal framework for AI, setting out guardrails for AI systems and rules for certain high-risk applications in the AI Act.

Meta AI, a chatbot and virtual assistant, has been built into WhatsApp’s interface across European markets since March. The Commission said a new policy fully applicable from January 15, 2026, may block competing AI providers from reaching customers via the platform. Ribera said the probe came on the back of complaints from small AI developers about the WhatsApp policy. The Interaction Company of California, which has developed AI assistant Poke.com, has taken its grievance to the EU competition enforcer. Spanish AI startup Luzia has also talked to the Commission, a person with knowledge of the matter said.

Marvin von Hagen, co-founder and CEO of The Interaction Company of California, said if Meta was allowed to roll out its new policy, “millions of European consumers will be deprived of the possibility of enjoying new and innovative AI assistants”. Meta also risks a fine of as much as 10% of its global annual turnover if found guilty of breaching EU antitrust rules.

Italy’s antitrust watchdog opened a parallel investigation in July into allegations that Meta leveraged its market power by integrating an AI tool into WhatsApp, expanding the probe in November to examine whether Meta further abused its dominance by blocking rival AI chatbots from the messaging platform. The antitrust probe is a more traditional means of investigation than the EU’s Digital Markets Act, the bloc’s landmark legislation currently used to scrutinize Amazon’s and Microsoft’s cloud services for potential curbs. Reuters

News

Billionaires are inheriting record levels of wealth, UBS report finds

The spouses and children of billionaires inherited more wealth in 2025 than in any previous year since reporting began in 2015, according to UBS’s Billionaire Ambitions Report published on Thursday. In the 12 months to April, 91 people became billionaires through inheritance, collectively receiving $298 billion, up more than a third from 2024, the Swiss bank said. “These heirs are proof of a multi-year wealth transfer that’s intensifying,” UBS executive Benjamin Cavalli said.

The report is based on a survey of some of UBS’s super-rich clients and a database that tracks the wealth of billionaires across 47 markets in all world regions. At least $5.9 trillion will be inherited by billionaire children over the next 15 years, the bank calculates.

Most of this inheritance growth is set to take place in the United States, with India, France, Germany and Switzerland next on the list, UBS estimated. However, billionaires are highly mobile, especially younger ones, which could change that picture, it added. The search for a better quality of life, geopolitical concerns and tax considerations are driving decisions to relocate, according to the report.

In Switzerland, where $206 billion will be inherited over the next 15 years according to the bank, voters on Sunday overwhelmingly rejected 50 per cent tax on inherited fortunes of $62 million or more, after critics said it could trigger an exodus of wealthy people.

Switzerland, the UAE, the U.S. and Singapore are among billionaires’ preferred destinations, UBS’s Cavalli said. “In Switzerland, Sunday’s vote may have helped to increase the country’s appeal again,” he said. Reuters

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG