News

Nigeria’s GDP grows at 7.68% – NBS

The National Bureau of Statistics (NBS) has disclosed that Nigeria’s Gross Domestic Product (GDP) stood at 7.68 per cent in the fourth quarter of 2011. The Statistician-General of the Federation, Dr. Yemi Kale, disclosed this in a statement in Abuja. He said that the figure was 0.92 per cent below the 8.60 per cent recorded in the corresponding period in 2010.

“On an aggregate basis, the economy, when measured by the Real Gross Domestic Product (GDP), grew by 7.68 per cent in the fourth quarter of 2011 as against 8.60 per cent in the corresponding quarter of 2010,’’ the statement said. It said that the 0.92 percentage decrease in Real GDP growth observed in the fourth quarter of 2011 was due to production shut-down in the oil sector during the period.

“On a nominal basis, the GDP for the fourth quarter of 2011 was estimated at N10.05 trillion as against the N9.46 trillion during the corresponding quarter of 2010, thus indicating an increase,’’ the statement said. The NBS said that the country’s GDP became more relevant because of Nigeria’s objective of being among the 20 largest economies in the world by the year 2020 would be measured by GDP.

“Out of the 46 countries that had released their GDP in the fourth quarter of 2011, only Mongolia and China stood at 14.9 per cent and 8.9 per cent, respectively. Two countries, as at the time of this report, grew faster than Nigeria, and China is ahead of Nigeria in current GDP rankings,’’ the statement said. It said that many countries which Nigeria surpassed continued to either recorded negative growth or grows slower than previously estimated during the visioning process.

“Nigeria may not need the double digit growth envisaged in the vision’s blueprint despite the fact that attaining double digit growth is within its (Nigeria) capacity,’’ the statement said. NBS said that the GDP growth was driven by growth in activities of the solid minerals, telecommunications, wholesale and retail trade, building and construction, hotel and restaurant, real estate and business services sectors.

“These sectors, which make up approximately 30.8 per cent of the nation’s GDP, each grew at an average rate of over 10 per cent during the year. Most vibrant is the communication sector, which grew at an average rate of 34.8 per cent in 2011. On the other hand, the oil sector output decreased as a result of the facilities shut down in the sector,’’ the statement said.

The bureau also stated that at 218.15 million barrels, crude oil and condensate production decreased by 6.9 per cent in the fourth quarter of 2011, with an average daily production of 2.4 million barrel. It stated that the production figure was lower when compared with the 234.33 million barrel production recorded in the fourth quarter of 2010, with a corresponding average production of 2.6 million barrels per day.

“Crude oil production, with its associated gas components, resulted in a growth rate in real term of 0.40 per cent in oil GDP in the fourth quarter of 2011 compared with the 6.68 per cent recorded in the corresponding quarter of 2010. Real GDP, driven by non-oil production activities, grew at 7.68 per cent in the fourth quarter 2011, ’’ the statement said. Accordingly, the Nigerian oil sector witnessed unprecedented levels of disruption compared to recent times due to temporary shutdown of facilities such as at Bonga, a 200,000 barrel per day (bpd) facility, which supplies about 10 per cent of Nigeria’s total crude output. However, the sector benefited immensely from the high international crude oil market price and the exchange rate regime of naira against the dollar in spite of decline in daily average production in the quarter under review. The oil sector contribution of about 14.64 per cent to real GDP in the fourth quarter 2010, however, dipped in the corresponding 2011 to 13.54 per cent,’’ the statement said.

News

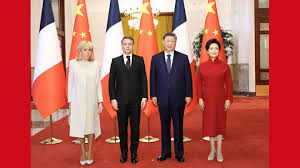

Nigeria–China tech deal to boost jobs, skills, local opportunities

A new technology transfer agreement between the Nigeria–China Strategic Partnership (NCSP) and the Presidential Implementation Committee on Technology Transfer (PICTT) is expected to open more job opportunities, improve local skills, and expand access to advanced technology for ordinary Nigerians.

In a press statement reaching Vanguard on Friday, the MoU aims to strengthen industrial development, support local content, and create clearer pathways for Nigerians to benefit from China’s growing investments in the country.

PICTT Chairman, Dr Dahiru Mohammed, said the partnership will immediately begin coordinated programmes that support local participation in infrastructure and industrial projects.

Special Adviser to the President on Industry, Trade and Investment, Mr John Uwajumogu, said the deal will help attract high value investments that can stimulate job creation and strengthen Nigeria’s economy.

NCSP Head of International Relations, Ms Judy Melifonwu, highlighted that Nigerians stand to gain from expanded STEM scholarships, technical training, access to modern technology, and collaboration across key sectors including steel, agriculture, automobile parks, and cultural industries.

The NCSP Director-General reaffirmed the organisation’s commitment to measurable results, noting that the partnership with PICTT will prioritise initiatives that deliver direct national impact.

The MoU signals a new phase of Nigeria–China cooperation focused on practical delivery, local content, and opportunities that improve everyday livelihoods.

News

EU hits Meta with antitrust probe over plans to block AI rivals from WhatsApp

EU regulators launched an antitrust investigation into Meta Platforms on Thursday over its rollout of artificial intelligence features in its WhatsApp messenger that would block rivals, hardening Europe’s already tough stance on Big Tech. The move, reported earlier by Reuters and the Financial Times, is the latest action by European Union regulators against large technology firms such as Amazon and Alphabet’s Google as the bloc seeks to balance support for the sector with efforts to curb its expanding influence.

Europe’s tough stance – a marked contrast to more lenient U.S. regulation – has sparked an industry pushback, particularly by U.S. tech titans, and led to criticism from the administration of U. S. President Donald Trump. The European Commission said that the investigation will look into Meta’s new policy that would limit other AI providers’ access to WhatsApp, a potential boost for its own Meta AI system integrated into the platform earlier this year.

EU antitrust chief Teresa Ribera said the move was to prevent dominant firms from “abusing their power to crowd out innovative competitors”. She added interim measures could be imposed to block Meta’s new WhatsApp AI policy rollout. “AI markets are booming in Europe and beyond,” she said. This is why we are investigating if Meta’s new policy might be illegal under competition rules, and whether we should act quickly to prevent any possible irreparable harm to competition in the AI space.”

A WhatsApp spokesperson called the claims “baseless”, adding that the emergence of chatbots on its platforms had put a “strain on our systems that they were not designed to support”, a reference to AI systems from other providers. “Still, the AI space is highly competitive and people have access to the services of their choice in any number of ways, including app stores, search engines, email services, partnership integrations, and operating systems.” The EU was the first in the world to establish a comprehensive legal framework for AI, setting out guardrails for AI systems and rules for certain high-risk applications in the AI Act.

Meta AI, a chatbot and virtual assistant, has been built into WhatsApp’s interface across European markets since March. The Commission said a new policy fully applicable from January 15, 2026, may block competing AI providers from reaching customers via the platform. Ribera said the probe came on the back of complaints from small AI developers about the WhatsApp policy. The Interaction Company of California, which has developed AI assistant Poke.com, has taken its grievance to the EU competition enforcer. Spanish AI startup Luzia has also talked to the Commission, a person with knowledge of the matter said.

Marvin von Hagen, co-founder and CEO of The Interaction Company of California, said if Meta was allowed to roll out its new policy, “millions of European consumers will be deprived of the possibility of enjoying new and innovative AI assistants”. Meta also risks a fine of as much as 10% of its global annual turnover if found guilty of breaching EU antitrust rules.

Italy’s antitrust watchdog opened a parallel investigation in July into allegations that Meta leveraged its market power by integrating an AI tool into WhatsApp, expanding the probe in November to examine whether Meta further abused its dominance by blocking rival AI chatbots from the messaging platform. The antitrust probe is a more traditional means of investigation than the EU’s Digital Markets Act, the bloc’s landmark legislation currently used to scrutinize Amazon’s and Microsoft’s cloud services for potential curbs. Reuters

News

Billionaires are inheriting record levels of wealth, UBS report finds

The spouses and children of billionaires inherited more wealth in 2025 than in any previous year since reporting began in 2015, according to UBS’s Billionaire Ambitions Report published on Thursday. In the 12 months to April, 91 people became billionaires through inheritance, collectively receiving $298 billion, up more than a third from 2024, the Swiss bank said. “These heirs are proof of a multi-year wealth transfer that’s intensifying,” UBS executive Benjamin Cavalli said.

The report is based on a survey of some of UBS’s super-rich clients and a database that tracks the wealth of billionaires across 47 markets in all world regions. At least $5.9 trillion will be inherited by billionaire children over the next 15 years, the bank calculates.

Most of this inheritance growth is set to take place in the United States, with India, France, Germany and Switzerland next on the list, UBS estimated. However, billionaires are highly mobile, especially younger ones, which could change that picture, it added. The search for a better quality of life, geopolitical concerns and tax considerations are driving decisions to relocate, according to the report.

In Switzerland, where $206 billion will be inherited over the next 15 years according to the bank, voters on Sunday overwhelmingly rejected 50 per cent tax on inherited fortunes of $62 million or more, after critics said it could trigger an exodus of wealthy people.

Switzerland, the UAE, the U.S. and Singapore are among billionaires’ preferred destinations, UBS’s Cavalli said. “In Switzerland, Sunday’s vote may have helped to increase the country’s appeal again,” he said. Reuters

-

News4 days ago

News4 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News4 days ago

News4 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News4 days ago

News4 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Economy4 days ago

Economy4 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Uncategorized2 days ago

Uncategorized2 days agoChevron to join Nigeria oil licence auction, plans rig deployment in 2026

-

News4 days ago

News4 days agoEU to support Nigeria’s war against insecurity