Finance

NSE lists FBNQuest Merchant Bank N5bn bond on its platform, market capitalisation drops N12.440trn

The Nigerian Stock Exchange (NSE) on Friday listed FBNQuest Merchant Bank N5 billion three-year 10.50 per cent bond on the bourse. The listing was commemorated with a digital closing gong done due to the COVID-19 pandemic in the country. Meanwhile the Exchange (NSE) moved a total of 221.45 million shares valued at N2.45 billion in 4,336 deals. This was against a turnover of 182.74 million shares worth N2.33 billion achieved in 4,542 deals on Thursday, representing an increase of 21.18 per cent. Market capitalisation of listed equities declined to N12.440 trillion from N12.441 trillion reported on Thursday.

An analysis of the activity chart indicated that Guaranty Trust Bank was the most active stock, exchanging 29.82 million shares valued at N670.96 million. It was trailed by UACN with 29.51 million shares worth N192.29 million, while Access Bank traded 21.11 million shares valued at N132.94 million. FBN Holdings exchanged 19.71 million shares worth N97.83 million, while Zenith Bank sold 18.69 million shares valued at N287.21 million. However, the All-Share Index closed lower at 23,871.33 from 23,892.92 recorded on Thursday, a decrease of 21.59 points or 0.09 per cent. Similarly, the market capitalisation which opened at N12.441 trillion lost one billion naira to close at N12.440 trillion. Dangote Cement topped the losers’ chart, dropping by N2.50 to close at N143.50 per share. MTN Nigeria trailed with a loss of 50k to close at N109.50, while C&I Leasing also dipped 50k to close at N4.60 per share. Guinness declined by 30k to close at N17.50, while Lafarge Africa shed 10k to close at N10.70 per share. Conversely, Presco led the gainers’ table, appreciating by N3.60 to close at N40.05 per share. Stanbic IBTC followed with a gain of N2.90 to close at N32.15, while NASCON added 50k to close at N10.55 per share. Guaranty Trust Bank garnered 50k to close at N22.50 , while GlaxoSmithKline increased by 45k to close at N6.35 per share.

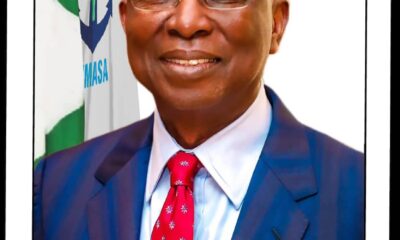

Commenting on the listing, Mr Oscar Onyema, NSE Chief Executive Officer, commended FBNQuest Merchant Bank for the debut listing of its N5 billion Series 1 bond on the Exchange. Onyema said the Exchange would continue to support the bank in meeting its capital raising needs and business objectives. “We also commend all the parties to the transaction. At the NSE, we are committed to giving issuers and investors a platform to access right-sized capital; even in the toughest of times as well as providing opportunities for secondary market trading activities across multiple asset classes, including equities, bonds and ETFs. Today, FBNQuest Merchant Bank is a beneficiary of this and we are pleased to welcome them,” Onyema said.

Speaking on the transaction, Mr Kayode Akinkugbe, FBNQuest Managing Director, commended market participants for the success of the bond. We are pleased to announce the listing of the FBNQuest Funding Special Purpose Vehicle Bond on The Nigerian Stock Exchange. This is the debut bond issued by the organisation, and the success recorded attests to the degree of confidence investors have in the business. “As a full-service investment bank and asset manager, we advised on the bond issuance and structure, and also leveraged our extensive distribution capability to ensure the success of the transaction,” he stated. FBNQuest Merchant Bank will be the second organisation honoured with a digital closing gong following the maiden edition earlier held in April with Sterling Bank.

The NSE digital closing gong ceremony attests to the resilience of the NSE’s technology platforms which have supported Dealing Members in trading remotely without incident via electronic platforms. In the past weeks, NSE has listed Flour Mills N12.5 billion three-year and N7.5 billion five-year Bonds; Primero BRT Securitisation SPV Plc bond worth N16.5 billion, and several Government bonds worth over N160 billion.

-

Economy12 hours ago

Economy12 hours agoCustoms, Kebbi govt partner on Niger-Benin transit corridor as FG opens trade routes

-

Oil and Gas12 hours ago

Oil and Gas12 hours agoNCDMB designed roadmap to $3.4tn continental market to unlocks AfCFTA market access for Nigeria’s energy sector

-

News12 hours ago

News12 hours agoGhana recalls High Commissioner to Nigeria

-

Economy12 hours ago

Economy12 hours agoShettima to convene NEC conference on Nigeria’s economic coordination

-

Finance12 hours ago

Finance12 hours agoFixed income market rallies, yields on Naira assets swing

-

Maritime12 hours ago

Maritime12 hours agoFG commends NIMASA DG on Nigeria’ IMO council election