News

Suit challenging Nigeria’s proposed expatriates tax to begin Dec

Justice Mohammed Umar of the Federal High Court in Abuja has fixed Dec. 1 for hearing in a suit seeking to stop the Federal Government from implementing the proposed expatriates’ taxation regime. The case, which was earlier scheduled for hearing by the new judge, could not proceed due to the ongoing judges’ conference. Although Paul Atayi, lawyer to the plaintiff and the defence counsel were in court, Justice Umar, who was recently reassigned to take over the matter, was absent. The case which was formerly before Justice Inyang Ekwo, is to start denovo (afresh) before Justice Umar. The plaintiff, Incorporated Trustees of New Kosol Welfare Initiative, had, in the motion ex-parte marked: FHC/ABJ/CD/1780/2024, sued the Interior Minister, Mr Olubunmi Tunji-Ojo, and Attorney-General of the Federation (AGF), Mr Lateef Fagbemi, SAN, as 1st and 2nd defendants. The plaintiff filed the application through a team of lawyers led by Atayi. The group sought an order of interim injunction restraining the defendants from commencing the implementation of the new Expatriates’ Taxation Regime known as the ‘Expatriate Employment Levy (EEL)’ in Nigeria, pending the hearing and determination of the motion on notice.

A Programme Implementation Coordinator of the group, Raphael Ezeh, in the affidavit he deposed to, averred that on Tuesday, Feb. 27, 2024, the Federal Government of Nigeria unveiled a set of proposed new taxation policy called the Expatriate Employment Levy (EEL). “According to KPMG and other online information analysts and dissemination agencies, the Federal Government intends to compel all companies and organisations who engage the services of foreign expatriates to pay tax E.E.L. as follows: For every expatriate on the level of a director — Fifteen Thousand United States Dollars ($15,000.00) equivalent to Twenty-Three Million Naira, by the current exchange rates (N23,000,000.00) per annum. “For every expatriate on a non-director level – Ten Thousand United States Dollars ($10,000.00) equivalent to Sixteen Million Naira, by the current exchange rates (N16,000,000.00) per annum,” he said. Ezeh averred that the Federal Government also planned additional regulations consisting of penalties and sanctions for non-compliance with the proposed taxation regime. According to him, inaccurate or incomplete reporting will attract five years’ imprisonment and/or N1 million fine.

He said failure of a corporate entity to file EEL within 30 day is to attract a penalty of N3 million, failure to register an employee within 30 days will also attract N3 million, while submission of false information will attract N3 million. The coordinator said failure to renew EEL before its expiry date by an organisation is to attract a sanction of N3 million. Ezeh said “the proposed taxation regime is totally an anti-people policy because of its radical effect on different aspects of the Nigerian economy and it works like a choke-hold against the economic growth of the nation.” He said taxation is a sensitive matter which, under the 1999 Constitution (as amended), calls for the collaboration of the executive and legislative arms of government. He said under Section 59 of the constitution, the executive arm of government alone does not have the power to impose tax on corporate bodies and other citizens of the nation. He said the current prevailing tax regime is far more friendly towards expatriates than the proposed one. Ezeh alleged that the minister is about to commence full implementation of the EEL.

But the minister and the AGF, in their respective preliminary objections filed before the former judge, urged the court to dismiss the suit in its entirety. Tunji-Ojo, in his preliminary objection filed on March 14 by Mrs Eva Omotese, Director, Legal Services, also urged the court to strike out his name from the suit. Giving five grounds of argument, the minister submitted that the group did not disclose its locus standi to initiate and maintain the suit as constituted. He said the failure of the plaintiff to disclose its locus standi robbed the court the jurisdiction to entertain the sult. Fagbemi, in his preliminary objection, equally argued that the group lacked the locus standi to file the suit. The AGF argued that there was no cause of action disclosed in the plaintiff’s suit.

Fagbemi, in the application filed by Maimuna Shiru, Director, Civil Litigation and Public Law, therefore, sought an order dismissing the suit for want of jurisdiction. But in the plaintiff’s reply on points of law to the AGF’s objection filed by Atayi, the lawyer cited reasons a court of law is vested with jurisdiction to hear a matter. The lawyer argued that a court would assume jurisdiction when it is properly constituted as regards numbers and qualifications of members of the bench, and that no member is disqualified for one reason or another. He also argued that the court would be vested with jurisdiction when the subject matter of the case is within its jurisdiction, and there is no feature in the case which prevents the court from exercising its jurisdiction. He further argued that the court can assume jurisdiction when the case before the court is initiated by due process of law, and upon fulfillment of any condition precedent to the exercise of jurisdiction. Atayi cited previous cases to back his argument including the Saraki Vs. Federal Republic of Nigeria’s case, 2016. The lawyer also argued that the case, being a public interest litigation, the plaintiff had the locus standi (legal right) to file the suit. He urged the court to dismiss the objections. The Federal Ministry of Interior had, earlier in 2024, suspended the implementation of the EEL which was launched on Feb. 27, 2024. This, it said is to allow for further consultations with the Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) and other vital stakeholders.

News

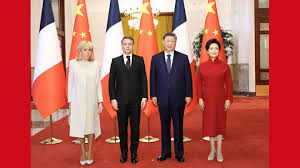

Nigeria–China tech deal to boost jobs, skills, local opportunities

A new technology transfer agreement between the Nigeria–China Strategic Partnership (NCSP) and the Presidential Implementation Committee on Technology Transfer (PICTT) is expected to open more job opportunities, improve local skills, and expand access to advanced technology for ordinary Nigerians.

In a press statement reaching Vanguard on Friday, the MoU aims to strengthen industrial development, support local content, and create clearer pathways for Nigerians to benefit from China’s growing investments in the country.

PICTT Chairman, Dr Dahiru Mohammed, said the partnership will immediately begin coordinated programmes that support local participation in infrastructure and industrial projects.

Special Adviser to the President on Industry, Trade and Investment, Mr John Uwajumogu, said the deal will help attract high value investments that can stimulate job creation and strengthen Nigeria’s economy.

NCSP Head of International Relations, Ms Judy Melifonwu, highlighted that Nigerians stand to gain from expanded STEM scholarships, technical training, access to modern technology, and collaboration across key sectors including steel, agriculture, automobile parks, and cultural industries.

The NCSP Director-General reaffirmed the organisation’s commitment to measurable results, noting that the partnership with PICTT will prioritise initiatives that deliver direct national impact.

The MoU signals a new phase of Nigeria–China cooperation focused on practical delivery, local content, and opportunities that improve everyday livelihoods.

News

EU hits Meta with antitrust probe over plans to block AI rivals from WhatsApp

EU regulators launched an antitrust investigation into Meta Platforms on Thursday over its rollout of artificial intelligence features in its WhatsApp messenger that would block rivals, hardening Europe’s already tough stance on Big Tech. The move, reported earlier by Reuters and the Financial Times, is the latest action by European Union regulators against large technology firms such as Amazon and Alphabet’s Google as the bloc seeks to balance support for the sector with efforts to curb its expanding influence.

Europe’s tough stance – a marked contrast to more lenient U.S. regulation – has sparked an industry pushback, particularly by U.S. tech titans, and led to criticism from the administration of U. S. President Donald Trump. The European Commission said that the investigation will look into Meta’s new policy that would limit other AI providers’ access to WhatsApp, a potential boost for its own Meta AI system integrated into the platform earlier this year.

EU antitrust chief Teresa Ribera said the move was to prevent dominant firms from “abusing their power to crowd out innovative competitors”. She added interim measures could be imposed to block Meta’s new WhatsApp AI policy rollout. “AI markets are booming in Europe and beyond,” she said. This is why we are investigating if Meta’s new policy might be illegal under competition rules, and whether we should act quickly to prevent any possible irreparable harm to competition in the AI space.”

A WhatsApp spokesperson called the claims “baseless”, adding that the emergence of chatbots on its platforms had put a “strain on our systems that they were not designed to support”, a reference to AI systems from other providers. “Still, the AI space is highly competitive and people have access to the services of their choice in any number of ways, including app stores, search engines, email services, partnership integrations, and operating systems.” The EU was the first in the world to establish a comprehensive legal framework for AI, setting out guardrails for AI systems and rules for certain high-risk applications in the AI Act.

Meta AI, a chatbot and virtual assistant, has been built into WhatsApp’s interface across European markets since March. The Commission said a new policy fully applicable from January 15, 2026, may block competing AI providers from reaching customers via the platform. Ribera said the probe came on the back of complaints from small AI developers about the WhatsApp policy. The Interaction Company of California, which has developed AI assistant Poke.com, has taken its grievance to the EU competition enforcer. Spanish AI startup Luzia has also talked to the Commission, a person with knowledge of the matter said.

Marvin von Hagen, co-founder and CEO of The Interaction Company of California, said if Meta was allowed to roll out its new policy, “millions of European consumers will be deprived of the possibility of enjoying new and innovative AI assistants”. Meta also risks a fine of as much as 10% of its global annual turnover if found guilty of breaching EU antitrust rules.

Italy’s antitrust watchdog opened a parallel investigation in July into allegations that Meta leveraged its market power by integrating an AI tool into WhatsApp, expanding the probe in November to examine whether Meta further abused its dominance by blocking rival AI chatbots from the messaging platform. The antitrust probe is a more traditional means of investigation than the EU’s Digital Markets Act, the bloc’s landmark legislation currently used to scrutinize Amazon’s and Microsoft’s cloud services for potential curbs. Reuters

News

Billionaires are inheriting record levels of wealth, UBS report finds

The spouses and children of billionaires inherited more wealth in 2025 than in any previous year since reporting began in 2015, according to UBS’s Billionaire Ambitions Report published on Thursday. In the 12 months to April, 91 people became billionaires through inheritance, collectively receiving $298 billion, up more than a third from 2024, the Swiss bank said. “These heirs are proof of a multi-year wealth transfer that’s intensifying,” UBS executive Benjamin Cavalli said.

The report is based on a survey of some of UBS’s super-rich clients and a database that tracks the wealth of billionaires across 47 markets in all world regions. At least $5.9 trillion will be inherited by billionaire children over the next 15 years, the bank calculates.

Most of this inheritance growth is set to take place in the United States, with India, France, Germany and Switzerland next on the list, UBS estimated. However, billionaires are highly mobile, especially younger ones, which could change that picture, it added. The search for a better quality of life, geopolitical concerns and tax considerations are driving decisions to relocate, according to the report.

In Switzerland, where $206 billion will be inherited over the next 15 years according to the bank, voters on Sunday overwhelmingly rejected 50 per cent tax on inherited fortunes of $62 million or more, after critics said it could trigger an exodus of wealthy people.

Switzerland, the UAE, the U.S. and Singapore are among billionaires’ preferred destinations, UBS’s Cavalli said. “In Switzerland, Sunday’s vote may have helped to increase the country’s appeal again,” he said. Reuters

-

News3 days ago

News3 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News3 days ago

News3 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News3 days ago

News3 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy3 days ago

Economy3 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

News3 days ago

News3 days agoEU to support Nigeria’s war against insecurity

-

Uncategorized3 days ago

Uncategorized3 days agoDeveloping Countries’ Debt Outflows Hit 50-Year High During 2022-2024—WBG