Tech

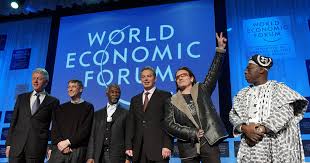

Tech sector growth under threat without value chain sustainability, WEF new report finds

The technology sector could unlock $800 billion in value across its value chain by 2030 if it puts nature at the heart of its operations and supply chains, according to a new World Economic Forum report launched today. This is part of the $10.1 trillion in business opportunity that could be unlocked if nature-positive solutions are adopted widely by the private sector.

Over half of the projected $800 billion comes from upstream activities in energy and extractives, such as expanding renewable power, improving resource recovery, and advancing circular manufacturing of electronics and appliances. This is according to the Nature Positive Role report developed in collaboration with Oliver Wyman. The new research also projects another third is expected from infrastructure and the built environment, including energy-efficient buildings, smart metering, wastewater reuse and sustainable construction. The rest may emerge from nature restoration and sustainable land use and cross-sector energy-efficiency opportunities enabled by digital innovation.

Tech sector growth is set to remain strong, propelled by artificial intelligence (AI), cloud computing, demand for high-performance electronics and frontier innovations, such as quantum computing. The growth of the sector brings with it a substantial nature footprint, including intensive water use, pollution and waste, greenhouse gas emissions and land pressures.

Over 1 trillion chips are sold each year, powering smartphones, cars, televisions and other everyday devices. Behind the scenes, more than 11,000 data centres are in use, and the demand for them is expected to rise by 19-22% annually to 2030. Semiconductor manufacturing alone uses over 1 trillion litres of water annually and depends on mining metals and critical minerals. Global data centres draw more than 60 gigawatts of power, exceeding the peak electricity demand of the whole of California. Hardware production contributes to more than 60 billion kilogrammes of e-waste each year, with less than a quarter currently being recycled.

Constraints on natural resources weaken operational efficiency and threaten business resilience. These can be addressed by adopting practices such as circular resource recovery, and by fostering partnerships across mining and minerals supply chains.

“Companies that invest in nature and transition towards net-zero, nature-positive and resilient business models will become better at managing risks and enjoy competitive advantages,” said Pim Valdre, Head of Climate and Nature Economy, World Economic Forum.

Tech’s rapid growth has led to a surge in infrastructure development, especially data centres, prompting increasing scrutiny from local communities and regulators. These advantages include stronger support from communities and regulators to grow, greater resilience to environmental shocks, as well as better alignment with what customers, employees and investors expect and new opportunities for growth and cost savings

The report finds that seven practical actions across water, pollution and waste, land use, greenhouse gas emissions, power, supply chain and policy engagement can help tech companies better manage their nature impacts and dependencies. By planning for the risks of nature loss, companies can limit disruptions, mitigate impacts from extreme weather events, policy or market transition and broader systemic issues, and reduce exposure tied to essential ecosystem services like clean water, while being first to capture nature positive opportunities.

As an example, the tech sector is currently responsible for around 4% of global energy use. By scaling renewable power, improving energy and water efficiency and advancing circular manufacturing and recycling models, the sector can reduce its nature impacts. Adopting innovations such as liquid cooling in data centers can reduce greenhouse gas emissions by up to 21%, while circular material recovery initiatives have achieved up to 95% emission reductions compared to virgin mining.

As Nick Studer, President and Chief Executive Officer of Oliver Wyman, noted, “The tech sector has an opportunity to lead in both economic growth and the nature-positive transition – but there is no time for delay.”

-

Economy12 hours ago

Economy12 hours agoBPE, stakeholders unite to rollout $500m free meters, DisCos pledge to lead drive

-

Finance12 hours ago

Finance12 hours agoCBN cuts 1-Year Treasury Bill rate, rejects Bids

-

Business12 hours ago

Business12 hours agoMTN to acquire controlling stake in IHS Holdings, eyes full ownership

-

Agriculture12 hours ago

Agriculture12 hours agoOver 2.5m metric tonnes of food valued N2trn produced in 2yrs—FG

-

News12 hours ago

News12 hours agoCourt orders British Govt. to pay £420m to 21 coal miners killed by colonial masters

-

Maritime12 hours ago

Maritime12 hours agoNIMASA mulls expansion of deep blue project, calls for continued partnership with Navy

-

Oil and Gas12 hours ago

Oil and Gas12 hours agoDangote refinery backs gantry loading, cautions against costly coastal evacuation

-

News12 hours ago

News12 hours agoRaham Bello, others launch N20bn endowment fund for alma mater