News

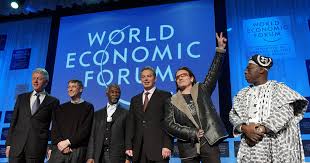

World Economic Forum unveils roadmap to unlock private climate finance in emerging markets, developing economies

World Economic Forum has said in a new report that emerging markets and developing economies will require $2.4 trillion in climate finance each year by 2030, including $1 trillion from primarily private international sources, to achieve climate targets, yet there are fiscal constraints and cuts in development finance.

The new report provides targeted actions for each stakeholder group in six priority areas to accelerate capital flow for climate-related growth in emerging markets and developing economies. The new research outlines an actionable roadmap, detailing 16 practical steps for governments, multilateral development banks, development finance institutions and institutional and private investors to mobilize private climate finance rapidly and at scale.

The Forum unveiled a stakeholder‑specific roadmap to mobilize private climate finance at scale in emerging markets and developing economies. The new report, from risk to reward: unlocking private capital for climate and growth, focuses on execution, outlining who should do what to build bankable pipelines, improve data and market intelligence, mobilize local capital and standardize risk‑sharing, amid growing investor attention to climate resilience, credit risk and the cost and availability of capital.

EMDEs require $2.4 trillion in climate finance annually by 2030, including $1 trillion from primarily private international sources. Yet current flows remain far below what is needed. EMDEs received $332 billion in 2023, with international private finance at $36 billion, underscoring the urgency to turn ambition into investable projects. The new research, developed to support policy‑makers, development finance institutions, investors and market participants, provides a practical pathway to accelerate low‑carbon, climate‑resilient growth where it is needed most. Collective action can unlock green growth and sustainable prosperity.

“Climate finance in developing economies is no longer just an environmental issue; it’s a systemic financial challenge that affects credit ratings, investor behaviour and long‑term growth,” said Laia Barbara, Head of Climate Strategy, World Economic Forum. “Mobilizing private capital at scale starts with clarity on who should do what. Public and private actors must collaborate more strategically, concentrating resources where they are most needed rather than duplicating efforts or inadvertently crowding out investment.”

The report identifies six priority areas backed by actionable steps for each stakeholder group: build investable project pipelines through public-private alliances, innovation funds, demand aggregation and bankability support; increase data transparency and local market intelligence via national platforms and digital analytics to reduce perceived risk and diligence frictions; mobilize local capital with credit guarantees and local‑currency instruments to lower FX risk and the cost of capital; simplify risk‑sharing mechanisms – standardized blended‑finance structures, first‑loss capital and climate insurance – to crowd in larger private flows; strengthen policy and regulatory certainty by translating national commitments into predictable, investable roadmaps and country platforms and expand equity investment structures (for example through platform vehicles or catalytic equity) to unlock patient capital for long‑term, scalable projects.

Mobilizing private climate finance at scale in EMDEs requires a holistic, systemic approach as well as clear policy signals, scalable risk-sharing tools and strong local partnerships to bridge the global climate finance gap. Building investor confidence hinges on a multi-stakeholder approach rooted in aligned incentives, trusted data, enabling policies and patient capital.

-

Economy1 day ago

Economy1 day agoDubai’s consumer electronics maker, Maser Group to invest $1.6bn in Nigeria, others

-

Oil and Gas1 day ago

Oil and Gas1 day agoEdo govt, NNPC partner to establish 10,000bpd condensate refinery

-

Economy1 day ago

Economy1 day agoFG inaugurates OGFZA, NEPZA boards for industrial growth

-

News1 day ago

News1 day agoNigeria inaugurates economic strategy to harness $8 trn global halal market

-

Oil and Gas1 day ago

Oil and Gas1 day agoOil falls as investors assess US-Iran talks

-

News1 day ago

News1 day agoGlobal digital currency, Crypto market capitalization crashes to $2.2trn on extreme fear

-

Stock Market1 day ago

Stock Market1 day agoNGX hits N110trn as market market capitalisation appreciated by 1.01%