Economy

Food inflation highest in Kwara, Kogi, Rivers in June–NBS

National Bureau of Statistics has said that prices of food items where highest in Kwara, Kogi and Rivers in the Month of June 2022. In its June inflation report the NBS said “in June 2022, food inflation on a year-on-year basis was highest in Kwara (25.62%), Kogi (24.81%), and River (24.34%), while Jigawa (16.01%), Sokoto (16.24%) and Kaduna (17.75%) recorded the slowest rise in year-on-year food inflation. On a month-on-month basis, however, in June 2022 food inflation was highest in Ebonyi (3.52%), Bayelsa (3.27%), and Ondo (3.25%), while Sokoto (0.11%), Taraba (0.94%) and Ad- amawa (1.22%) recorded the slowest rise on month-on-month inflation. In June 2022, all items inflation on a year-on-year basis was highest in Bauchi (21.99%), Kogi (21.37%), Ebonyi (20.73%) while Adamawa (16.14%), Sokoto (16.31%) and Jigawa (16.37%) recorded the slowest rise in headline Year-on-Year inflation”.

According to NBS “On a month-on-month basis, however, June 2022, recorded the highest increases in Kogi (2.69%), Ondo (2.65%), and Kaduna (2.61%), while Adamawa (-0.26%), Abuja (-.0.03%) and Sokoto (0.79%) recorded the slowest rise on month-on-month inflation. In June 2022, the inflation rate increased to 18.60 per cent on a year-on-year basis. This is 0.84 per cent points higher compared to the rate recorded in June 2021, which is 17.75 per- cent. This means that the headline inflation rate increased in the month of June 2022 when compared to the same month in the previous year (i.e., June 2021). Increases were recorded in all COICOP divisions that yielded the Headline index. On a month-on-month basis, the Headline inflation rate increased to 1.82 percent in June 2022, this is 0.03 percent higher than the rate recorded in May 2022 (1.78 percent)

The percentage change in the average composite CPI for the twelve months period ending June 2022 over the average of the CPI for the previous twelve months period is 16.54 percent, showing a 0.62 percent increase compared to 15.93 percent recorded in June 2021. In the month of June 2022, the urban inflation rate increased to 19.09 percent (year-on-year); this is a 0.74 percent increase compared to 18.35 percent recorded in June 2021. On a month -on-month basis, the urban inflation rate rose to 1.82 percent in June 2022, this is a 0.01 per- cent increase compared to May 2022 (1.81 percent). The corresponding twelve-month aver- age percentage change for the urban index is 17.09 percent in 2022. This is 0.58 percent higher compared to 16.51 percent reported in June 2021.

The rural inflation rate increased to 18.13 percent in June 2022 (year-on-year) basis; this is a 0.97 percent increase compared to 17.16 recorded in June 2021. On a month-on-month basis, the rural index rose to 1.81 percent in June 2022, up by 0.05 percent from the rate recorded in May 2022 (1.76 percent), while the corresponding twelve-month average percentage change for the rural inflation rate in June 2022 is 16.02 percent. This is 0.66 percent higher compared to 15.36 percent recorded in June 2021.

The composite food index rose to 20.60 percent in June 2022 on a year-on-year basis; the rate of changes in average price level declined by 1.23 percent compared to 21.83 percent in June 2021. The rate of changes in food prices compared to the same period last year was higher due to higher foods prices volatility caused by COVID 19. This rise in the food index was caused by increases in prices of Bread and cereals, Food products n.e.c, Pota- toes, yam, and other tubers, Meat, Fish, Oil and fat, and Wine. On a month-on-month basis, the food sub-index increased to 2.05 percent in June 2022, up by 0.03 percent points from 2.01 percent recorded in May 2022. The average annual rate of change of the Food sub-index for the twelve-month period ending June 2022 over the previous twelve-month average is 18.62 per cent, which is 1.10 percent points decline from the average annual rate of change recorded in June 2021 (19.72 percent).

“The ‘’All items less farm produce’’ or Core inflation, which excludes the prices of volatile ag- ricultural produce stood at 15.75 percent in June 2022 on a year-on-year basis, up by 2.66 percent when compared to 13.09 percent recorded in June 2021. On a month-on-month basis, the core sub-index increased to 1.56 percent in June 2022. This is down by 0.31 percent when compared to 1.87 percent recorded in May 2022. The highest increases were recorded in prices of Gas, Liquid fuel, Solid fuel, Garments, Passenger transport by road, Cleaning, Repair and Hire of clothing, Passenger travel by Air The average 12-month annual rate of change of the index was 14.06 percent for the twelve- month period ending June 2022; this is 2.31 percent points higher than the 11.75 percent recorded in June 2021”.

Economy

Nigeria champions African-Arab trade to boost agribusiness, industrial growth

The Arab Africa Trade Bridges (AATB) Program and the Federal Republic of Nigeria formalized a partnership with the signing of the AATB Membership Agreement, officially welcoming Nigeria as the Program’s newest member country. The signing ceremony took place in Abuja on the sidelines of the 5th AATB Board of Governors Meeting, hosted by the Federal Government of Nigeria.

The Membership Agreement was signed by Eng. Adeeb Y. Al Aama, the CEO of the International Islamic Trade Finance Corporation (ITFC) and AATB Program Secretary General, and H.E. Mr. Wale Edun, Minister of Finance and Coordinating Minister of the Economy, Federal Republic of Nigeria. The Agreement will provide a strategic and operational framework to support Nigeria’s efforts in trade competitiveness, promote export diversification, strengthen priority value chains, and advance capacity-building efforts in line with national development priorities. Areas of collaboration will include trade promotion, agribusiness modernization, SME development, businessmen missions, trade facilitation, logistics efficiency, and digital trade readiness.

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, called for deeper trade collaboration between African and Arab nations, stressing the importance of value-added Agribusiness and industrial partnerships for regional growth. Speaking in Abuja at the Agribusiness Matchmaking Forum ahead of the AATB Board of Governors Meeting, the Minister said the shifting global economy makes it essential for African and Arab nations to rely more on regional cooperation, investment and shared markets.

He highlighted projections showing Arab-Africa trade could grow by more than US$37 billion in the next three years and urged partners to prioritize value addition rather than raw commodity exports. He noted that Nigeria’s growing industrial base and upcoming National Single Window reforms will support efficiency, investment and private-sector expansion.

“This is a moment to turn opportunity into action”, he said. “By working together, we can build stronger value chains, create jobs and support prosperity across our regions”, Edun emphasized. “As African and Arab nations embark on this journey of deeper trade collaboration, the potential for growth and development is vast. With a shared vision and commitment to value-added partnerships, we can unlock new opportunities, drive economic growth, and create a brighter future for our people.”

Speaking during the event, Eng. Adeeb Y. Al Aama, Chief Executive Officer of ITFC and Secretary General of the AATB Program, stated: “We are pleased to welcome Nigeria to be part of the AATB Program. Nigeria stands as one of Africa’s most dynamic and resilient economies in Africa, with a rapidly expanding private sector and strong potential across agribusiness, energy, manufacturing, and digital industries. Through this Membership Agreement, we look forward to collaborating closely with Nigerian institutions to strengthen value chains, expand regional market access, enhance trade finance and investment opportunities, and support the country’s development priorities.”

The signing of this Agreement underscores AATB’s continued engagement with African countries and its evolving portfolio of programs supporting trade and investment. In recent years, AATB has worked on initiatives across agribusiness, textiles, logistics, digital trade, export readiness under the AfCFTA framework, and other regional initiatives such as the Common African Agro-Parks (CAAPs) Programme.

With Nigeria’s accession, the AATB Program extends it’s presence in the region and adds a key partner working toward advancing trade-led development and fostering inclusive economic growth.

Economy

FEC approves 2026–2028 MTEF, projects N34.33trn revenue

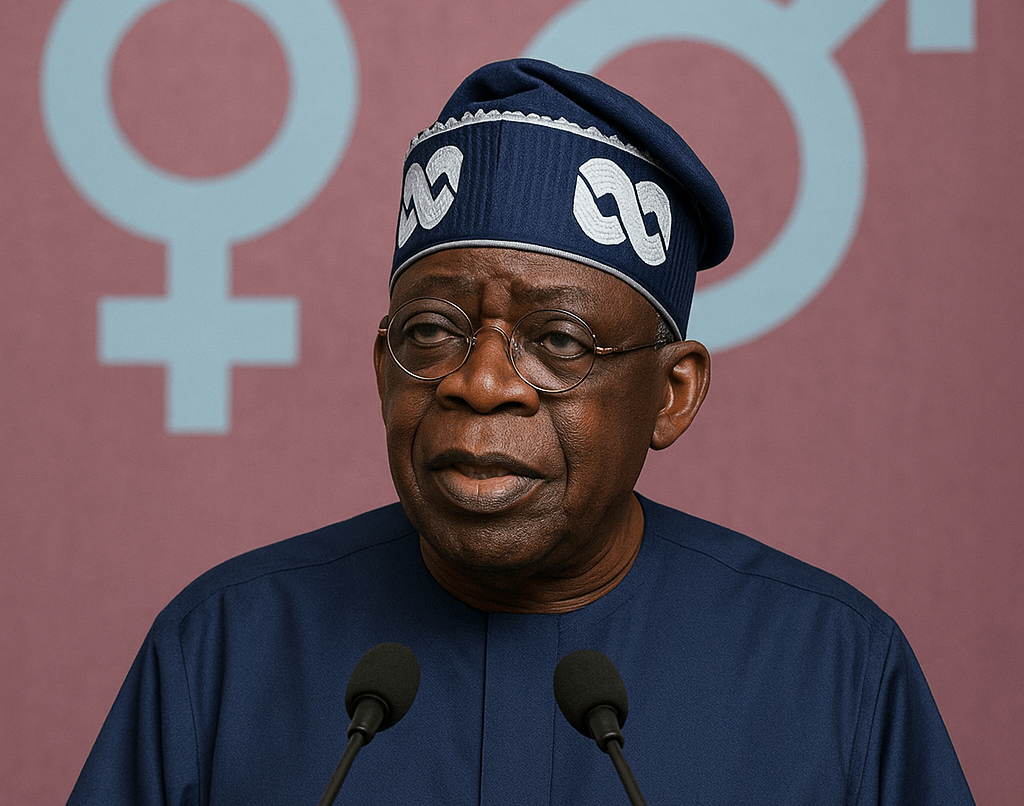

Federal Executive Council (FEC) has approved the 2026–2028 Medium-Term Expenditure Framework (MTEF), a key fiscal document that outlines Nigeria’s revenue expectations, macroeconomic assumptions, and spending priorities for the next three years. The approval followed Wednesday’s FEC meeting presided over by President Bola Tinubu at the State House, Abuja. The Minister of Budget and Economic Planning, Senator Atiku Bagudu made this known after the meeting.

The Minister said the Federal Government is projecting a total revenue inflow of N34.33 trillion in 2026, including N4.98 trillion expected from government-owned enterprises. Bagudu said that the projected revenue is N6.55 trillion lower than earlier estimates, adding that federal allocations are expected to drop by about N9.4 trillion, representing a 16% decline compared to the 2025 budget.

He said that statutory transfers are expected to amount to about N3 trillion within the same fiscal year. On macroeconomic assumptions, FEC adopted an oil production benchmark of 2.6 million barrels per day (mbpd) for 2026, although a more conservative 1.8 mbpd will be used for budgeting purposes. An oil price benchmark of $64 per barrel and an exchange rate of N1,512 per dollar were also approved.

Bagudu said the exchange rate assumption reflects projections tied to economic and political developments ahead of the 2027 general elections. He said the exchange rate assumption took into account the fiscal outlook ahead of the 2027 general elections.

The minister said that all the parameters were based on macroeconomic analysis by the Budget Office and other relevant agencies. Bagudu said FEC also reviewed comments from cabinet members before approving the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which sets expenditure limits. Earlier, the Senate approved the external borrowing plan of $21.5 billion presented by President Tinubu for consideration The loans, according to the Senate, were part of the MTEF and Fiscal Strategy Paper (FSP) for the 2025 budget.

Economy

CBN hikes interest on treasury Bills above inflation rate

The spot rate on Nigerian Treasury bills has been increased by 146 basis points by the Central Bank of Nigeria (CBN) following tight subscription levels at the main auction on Wednesday. The spot rate on Treasury bills with one-year maturity has now surpassed Nigeria’s 16.05% inflation by 145 basis points following a recent decision to keep the policy rate at 27%.

The Apex Bank came to the primary market with N700 billion Treasury bills offer size across standard tenors, including 91-day, 182-day and 364 day maturities. Details from the auction results showed that demand settled slightly above the total offers as investors began to seek higher returns on naira assets despite disinflation.

Total subscription came in at about N775 billion versus N700 billion offers floated at the main auction. The results showed rising appetite for duration as investors parked about 90% of their bids on Nigerian Treasury bills with 364 days maturity. The CBN opened N100 billion worth of 91 days bills for subscription, but the offer received underwhelming bids totalling N44.17 billion.

The CBN allotted N42.80 billion for the short-term instrument at the spot rate of 15.30%, the same as the previous auction. Total demand for 182 days Nigerian Treasury bills settled at N33.38 billion as against N150 billion that the authority pushed out for subscription. The CBN raised N30.36 billion from 182 days bills allotted to investors at the spot rate of 15.50%, the same as the previous auction.

Investors staked N697.29 billion on N450 billion in 364-day Treasury bills that was offered for subscription. The CBN raised N636.46 billion from the longest tenor at the spot rate of 17.50%, up from 16.04% at the previous auction.

-

News4 days ago

News4 days agoNigeria to officially tag Kidnapping as Act of Terrorism as bill passes 2nd reading in Senate

-

News4 days ago

News4 days agoNigeria champions African-Arab trade to boost agribusiness, industrial growth

-

News4 days ago

News4 days agoFG’s plan to tax digital currencies may push traders to into underground financing—stakeholders

-

News1 week ago

News1 week agoFG launches fresh offensive against Trans-border crimes, irregular migration, ECOWAS biometric identity Card

-

Finance1 week ago

Finance1 week agoAfreximbank successfully closed its second Samurai Bond transactions, raising JPY 81.8bn or $527m

-

Economy4 days ago

Economy4 days agoMAN cries out some operators at FTZs abusing system to detriment of local manufacturers

-

Uncategorized2 days ago

Uncategorized2 days agoChevron to join Nigeria oil licence auction, plans rig deployment in 2026

-

News4 days ago

News4 days agoEU to support Nigeria’s war against insecurity